In the middle of worst financial crisis of 14 years, when the average investor’s portfolio plunged by 44% (according to JP Morgan), Keith Kaplan’s and his team from TradeSmith are launching The 10,000 New Millionaires Project. They say it is the the biggest undertaking in their history.

They’re formally announcing their intention to teach at least 10,000 people on how to earn their first million dollars in the stock market.

In this article we’ll share the insight of Keith Kaplan’s The 10,000 New Millionaires Project.

— RECOMMENDED —

The Market Hasn’t Done This in 15 Years

The Market Hasn’t Done This in 15 Years

Wealth has evaporated. Companies are announcing salary freezes and unpaid furloughs. The price of everything keeps climbing while the values of our most precious assets, like our homes and investment accounts, are depreciating. There’s a strange reason why, but Wall Street won’t tell you about it.

Click here to get the full story.

Who is Keith Kaplan?

Keith Kaplan is the CEO of TradeSmith. TradeSmith is a company that provides knowledge and tools to individual investors to outperform the financial market.

They have over 69,000 members worldwide with over $30 billion in financial assets.

They don’t really manage the money. TradeSmith’s team includes data scientists, mathematicians, and coders that are focused to discover different ways to make money in stocks. Their approach makes money even in challenging markets.

Their success is based on a special stock market signal. They call it Volatility Quotient. Only few analysts know about it. It is not popular, and we don’t know any other analysts to use it. But as you’re going to discover, Keith Kaplan and his TradeSmith team had amazing results using this Volatility Quotient indicator.

For the last 17 years they build a hardware platform that uses algorithm that was first discovered by two Nobel-Prize winning economists. TradeSmith team can track over 150,000 securities, including 51,000 publicly traded stocks, ETFs and index funds.

During the presentation, Keith Kaplan shares that using their VQ signals, their followers have the possibility to gain as much as 861%… 964%… 1,129%… 2,334%… over the past few years.

10,000 New Millionaires Project Review – What Is All About?

As we mentioned earlier, Kaplan and his team are currently helping 69,000 people in their stock market journey.

Obviously, they want to do more. Their goal is to put at least 10,000 people on the path to seven-figure financial success.

They call it “10,000 New Millionaires Project”.

Regarding their $1 million goal, there is no way to predict whether or when you will reach it. Because it will vary for each person according on what investment they will start with. Regardless of if you’re starting with $500 or $500,000, ther discovery could help you radically accelerate your outcome.

Bottom line: Volatility Quotient can help you reduce risks, minimize losses, and improve your gains in any market conditions in any size portfolio. This powerful strategy is about showing you how to improve your “win” rate on every trade… across your portfolio… at a steady, intelligent pace.

How Volatility Quotient Signal Works?

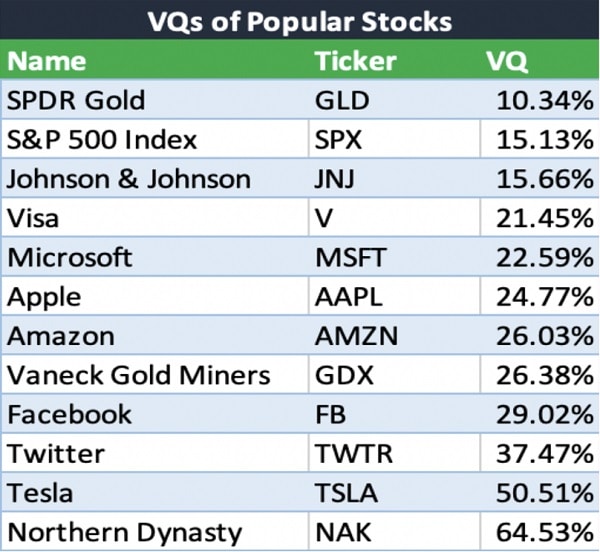

Every one of over 150,000 securities, including all 51,254 publicly traded stocks and funds can generate a VQ signal. Here are VQs of some of the most popular stocks:

When you compare these VQ scores, you will see that they are not the same. Because not all stocks behave the same way. The VQ demonstrates the range a stock may have when it begins to go up and down in accordance with its usual pattern.

As a result of their frequent movement, highly volatile stocks typically have higher VQ scores.

Less volatile stocks typically move within a narrower range, resulting in lower VQ scores.

More or less volatility doesn’t mean it’s bad.

It simply means that depending on what the norm is for a share, it will respond to significant price changes differently.

For example, if a high VQ stock like AMD is increasing significantly, you should not need to be concerned. Because it has a long history of trading in a wide range.

A low VQ stock like Johnson & Johnson, on the other hand, rarely has price movements of more than 15.66%.

When it does, you should expect a significant event. It could be time to get out fast.

In a downturn, VQ can estimate how much you would lose on every given share. It can also let you know whether a selloff is overstated and that you may consider purchasing more.

When a stock is rising, you can check the VQ to see if it is getting too hot or if there is still opportunity for growth. in order to increase the potential return.

Looks like TradeSmith is the only research firm that is calculating the VQ for every stock and then translating the signals into trading recommendations.

It is not an easy process. They are using more than 3,053 past and present data points… with a combined total of 9,250 calculations per day… per stock… every single day.

Practically it is impossible for one person to do it at home. In fact, TradeStops Plus platform requires more than 15 data scientists and coders, and millions of dollars in development.

How can Volatility Quotient help you?

If the market averages 10% per year, it will take a little under 8 years to double your money.

Imagine now performing 9X better, or even only 5X greater than the industry standard. In less than two years, you would double your money.

As Keith Kaplan said: “If you’re making money many times faster, you’re getting to $1 million faster.”

Actually, using the TradeStops Plus platform is incredibly easy.

How to use TradeStops Plus platform?

For example, let’s take Apple’s ticker:

TradeStops Plus tool gave it a VQ Score of 28.25%. This means that considering Apple’s price changes over time, the stock mostly traded above or below its current price of 28.25%.

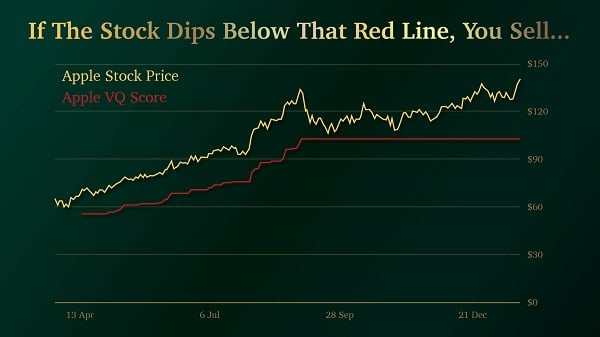

Below the scoring report, you will find a chart like this one:

The VQ score changes over time.

If Apple drops below red line, you should get out.

You might wish to buy more or sell for possible gains if it continues to trade above the VQ line.

Keep in mind, 28% signal might be a low signal for one stock but high for another one.

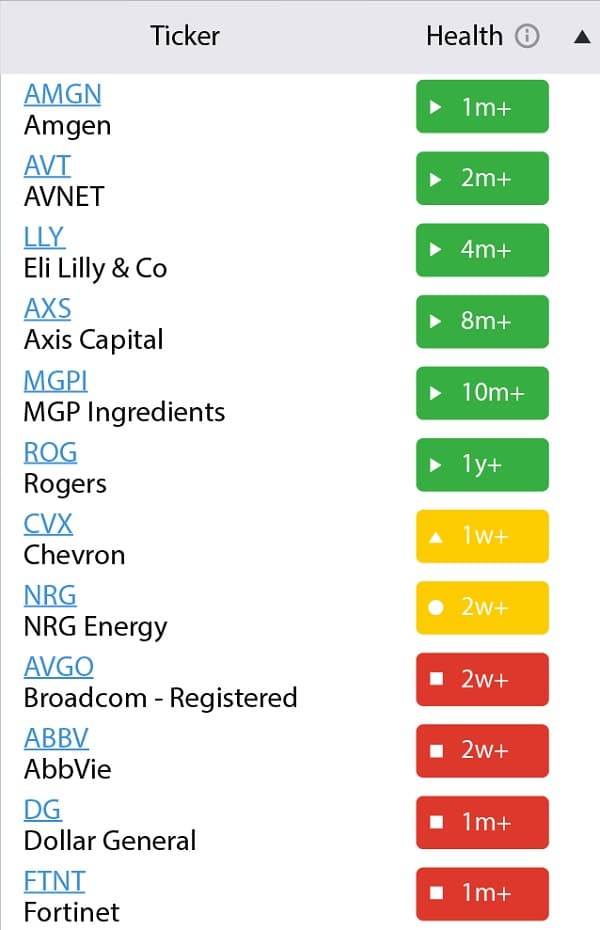

The best part is that you never have to guess, because the signals in TradeStops Plus are clear. They are based on the health of every ticker.

Here is an example:

Green means that the stock is in good health, and it is time to buy.

Yellow means it could go either way and you have to be careful.

You should consider selling if it is red since it is outside of its normal range.

You can monitor the data 24/7.

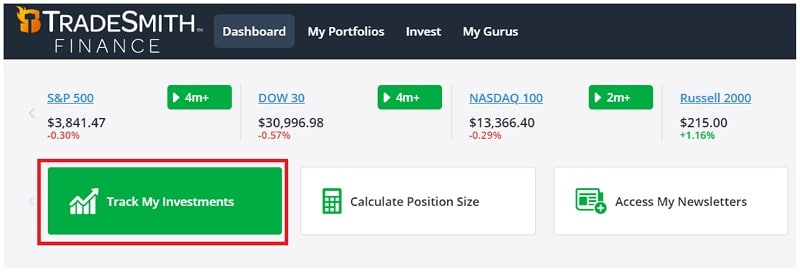

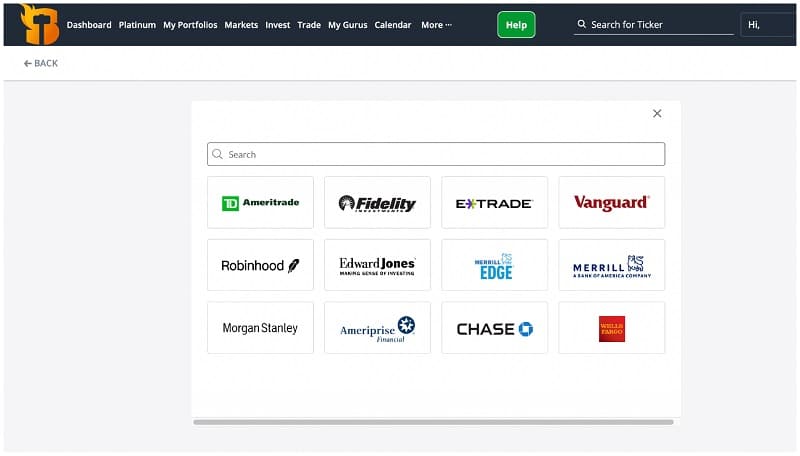

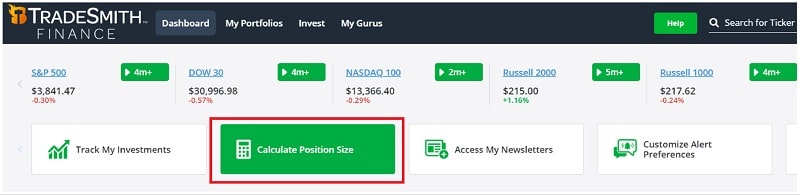

Another useful feature built into TradeStops Plus is the ability to get instant score of the securities in your personal portfolio. It is completely private, and very easy to set up. Just click the green button when you first open the dashboard.

After you click the button “Track my Investments”, a page that lists popular brokers will open on your screen.

If you don’t see yours, enter it into the search bar.

Next to the ticker, each stock you own will have a “stoplight” alert tile attached to it. You can quickly determine the risk associated with any holding by pressing a button.

You can also do a search for a stock you are interested in but do not currently own.

How to keep the risk and the stability of your portfolio in balance?

One of the most important aspects of your portfolio is not only what stocks you own, but also how many stocks you have.

Of course, a little risk is worth it. After all, that’s how you get the bigger reward.

The delicate balance is sometimes difficult to find. TradeStops Plus has a solution.

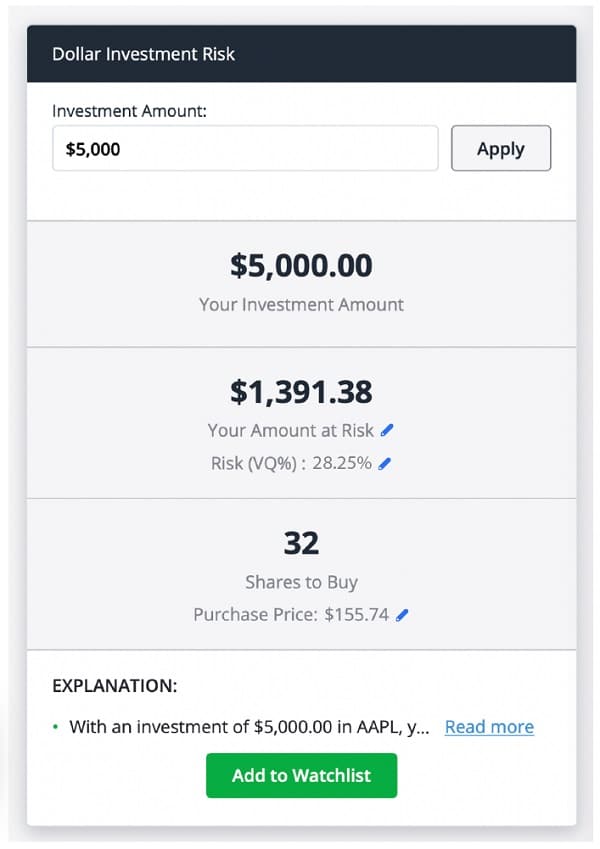

On your dashboard you will find a button “Calculate Portion Size”.

It will give you the information how much risk there is for any dollar amount you want to invest in a specific share.

For example, if we enter “AAPL” into the Position Size Calculator and check how much risk is associated with a $5,000 position. The system gives an instant result, showing that with a VQ score of 28%, $1,391.38 of invested $5,000 are at risk.

Therefore, based on typical market volatility, I may anticipate my position to move up or down by about that much if Apple continues to act like it has in the past.

Any ticker’s ideal position size can be calculated.

There is another feature that most people like.

TradeStops Plus partnered with some of the best financial newsletters from some of the biggest publishers. With this build-in feature you can see their actual model portfolios. And get an instant VQ score on the health status of every one of their positions.

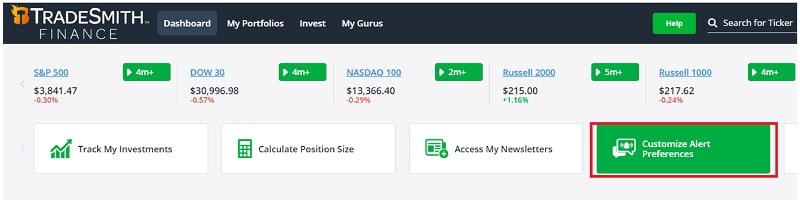

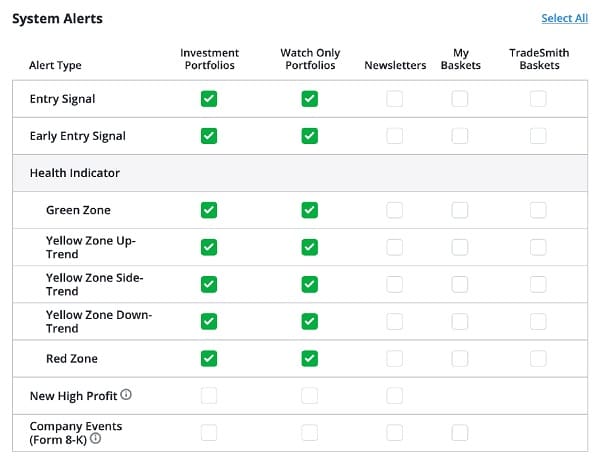

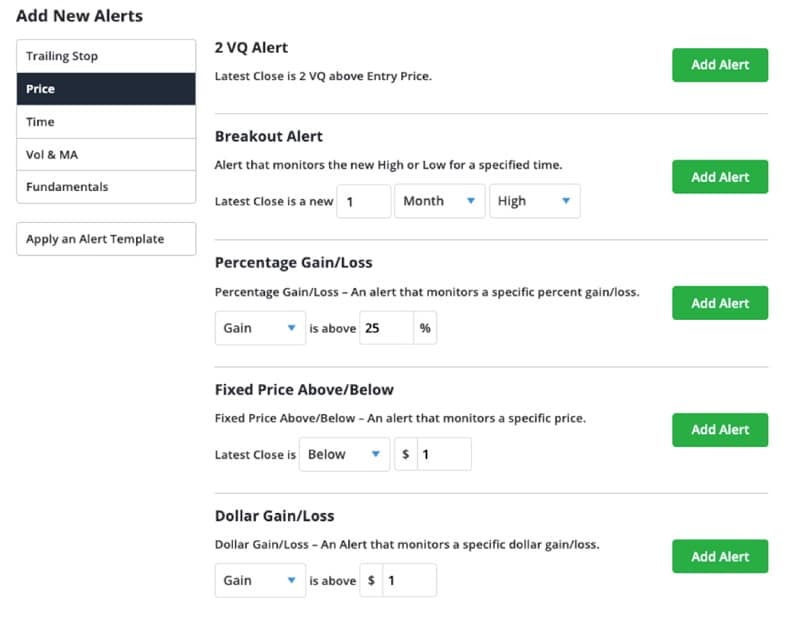

Customized Alerts

Additionally, you can use the TradeStops Plus dashboard to individually tailor trade alerts for every position you wish to monitor.

The button “customize Alert Preferences” will open a page where you set up your preferences.

Additionally, you can set up specific notifications for each of your positions.

The software can notify you for changes in share price, gains, highs on any ticker you are watching closely, so you can enjoy your life.

We have covered only some of the functions of TradeStops Plus. Setting up the system to fit your needs is easy. They have almost 30 video tutorials and recorded training classes.

There is “Help” button on every page with step-by step answers for many questions.

If you need additional help, you can always reach out to their full-time education specialist.

How much is TradeStops Plus?

For short time, you can get TradeStop Plus for just $79. This is great opportunity to get full year of unlimited access. With this deal, you will also get:

- You will have access to VQ scores for more than 150,000 different securities.

- Full access to our VQ-powered “stoplight” alert system, which provides you with notifications for purchase, hold, and sell in green, yellow, and red… immediately on more than 51,000 stocks.

- Secure assessment of your own portfolio data to give you a quick, private, and secure evaluation of the condition of your investments.

- Instant risk and position sizing allows you to see how much risk you’re taking on and how many shares to buy.

- Access to “newsletter center,” where you can link the model portfolios of your favorite gurus and get an updated read on the health of their picks too.

- You can relax knowing that if a buy, hold, or sell signal is issued on one of your favorite companies, you’ll be informed about it thanks to completely customizable alerts.

- Bonus Report #1: When to Sell 50 of the World’s Most Popular Stocks

- Bonus Report #2: Beat the Billionaires: Insights, Errors, and Recommendations from the Brightest Minds on Wall Street

- Bonus Report #3: The Millionaire Master Plan

- For extra help getting set up, you can always schedule an appointment with TradeStops Plus concierge.

- Keith Kaplan is generous with their return policy. You will get 60 days to explore their platform. If you are not happy, you get a full refund.

— RECOMMENDED —

Huge Recession Loophole (See These Charts)

Huge Recession Loophole (See These Charts)

Amid today’s market turmoil, THIS is one of the biggest and most bullish opportunities today: a red-hot sector with almost unlimited pricing power and a history of outperforming in recessions. It’s also the sector where our good friend Dr. David Eifrig spent half his professional life – meaning he’s extremely qualified to spot world-class opportunities today.

Take a look at the evidence here.

Final Words

We all try to make sense of rough markets and our own doubts what to do next and how much financial risk to take. Imagine how much easier would be if you have numbers in front of you showing what to buy, how much to purchase and exactly when to cash out for possible gains.

This is exactly what TradeStop Plus is built to do for its users.

With risk-free option to use it in the next 60 days, there is nothing to lose really.

1 thought on “TradeStops Plus 10,000 New Millionaires Project Review – Is It Legit?”