Teeka Tiwari Crypto’s Next Trillion Dollar Coin – Watch The Replay Here

Get 1 Year of Palm Beach Confidential (Half Off)

Teeka Tiwari wants you to radically rewire your portfolio… Is gold the past and bitcoin the future? What’s Teeka Tiwari Crypto’s Next Trillion Dollar Coin Portfolio?

Table of Contents

Gold is Losing Ground As a Store Of Wealth

“Gold isn’t cutting it anymore” says Teeka Tiwari in a new recommendation to his readers over at Palm Beach Research Group.

Teeka got his start in finance over three decades ago, when he worked at Wall Street investment bank Shearson Lehman. At just 19 years of age, he became the youngest-ever vice president there. He then ran his own hedge fund… before joining the newsletter publishing business to help regular folks beat the market.

Nearly all that time, he’s been a fan of gold as wealth protection.

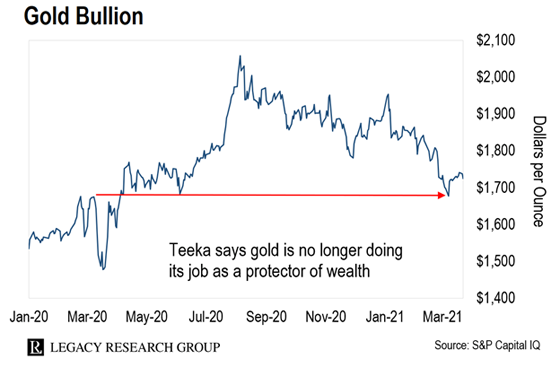

But now gold has been falling since its peak last July.

After a marginal rise last year, it fell back to where it was in March 2020, when the COVID-19 pandemic hit the United States. It’s since ticked up a bit to where it was last June.

That’s odd, given what’s going on at a macro level. As Teeka put it…

Even though the U.S. spent more than $5.3 trillion on coronavirus relief in the last year… and our stimulus spending (more than we’ve seen from any other country on the planet) is worth a staggering 27% of our annual GDP… gold hasn’t done a thing.

As a result, he’s come out with a bold new call. He says gold is losing ground as a store of wealth. And he’s urging readers to replace some of their gold with bitcoin.

This is seismic. Especially if you’re a long-term gold owner.

So today we’ll unpack Teeka’s big call for you. As you’ll see, it involves radically rewriting your portfolio.

— RECOMMENDED —

$500 Bonus! (Free Gift From Teeka Tiwari)

Former Wall Street VP and hedge fund manager Teeka Tiwari is giving away an unprecedented $500 in bonuses.

Click here to get $500 in free bonuses from Teeka

Teeka Tiwari: Rewrite Your Portfolio Now

It sure is strange to see gold falling right now…

With so many concerns over the size of the stimulus Washington and the Fed are pumping out, you’d expect gold to rally. There’s only so much gold on Planet Earth. And it’s expensive to produce more of. You need diggers, dozers, workers, and permits… and you often have to mine in politically unstable countries.

Gold’s scarcity makes it inflation-proof. That should make it a go-to choice for folks worried about U.S. dollar inflation.

But the chart above shows investors don’t care.

Meanwhile, folks can’t get enough of bitcoin…

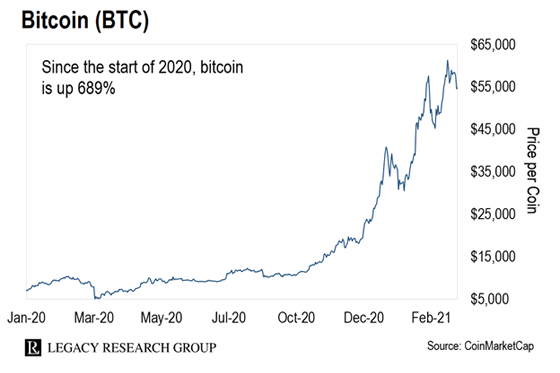

This chart says it all…

As you can see, since the start of 2020, bitcoin (BTC) is up 689%.

Here’s what’s really strange…

Bitcoin does the same thing as gold… protecting investors against inflation… only digitally. There’s a finite supply – a hard cap of 21 million bitcoins. And it’s expensive for “miners” to create new bitcoins. The computer hardware and energy costs involved in keeping the bitcoin network secure are enormous.

To give you an idea, the energy these computers need to run for a year is roughly the same as the energy necessary to power Argentina, a country of 45 million people, for the same time frame.

Because of their similarities, you’d expect both bitcoin and gold to perform well under current conditions. But as you saw, gold is struggling.

This brings us to Teeka’s big call…

As he told his Palm Beach readers, there’s one reasonable explanation for what’s happening…

Gold has finally been replaced by something better. And that something is bitcoin.

Teeka was right on bitcoin when he first recommended it to his readers at about $400 a coin in April 2016. He’s handed them the opportunity to make as much as a 13,900% gain since then.

And he recently had Palm Beach Confidential readers take profits on 13 other coins in the model portfolio. They were up an average of 4,733%.

So it’s worth at least hearing him out… even if you’re a dyed-in-the-wool “gold bug.”

Teeka compares the current dynamic to the car versus the horse and buggy…

He shared this passage from Scientific American with his readers…

In 1907, there were 140,300 cars registered in the U.S. and a paltry 2,900 trucks. People and goods still travelled long distances on land by railroad, and short distances by foot or horse-drawn carriage. […]

Ten years later in 1917, there had been a 33-fold increase in the number of cars registered, to almost 5 million, and a 134-fold increase in the number of commercial, agricultural and military vehicles, to almost 400,000. Horses were now an imperilled minority on the roads.

That’s how Teeka sees gold and bitcoin. Here he is with more…

Gold has thousands of years of history. Bitcoin has been around for only a decade. I get it. But people also used horses to get around for thousands of years. Then, in less than a decade, cars rendered horses obsolete.

It’s not hard to imagine bitcoin replacing gold in the same way. One study from deVere Group, an independent financial advisory organization, revealed that more than two-thirds of millennials prefer bitcoin over gold as a safe-haven asset.

They function similarly and offer many of the same benefits. Bitcoin is equally scarce, durable, and private as gold. But it’s more easily stored, transported, and exchanged than gold. That makes gold the horse… and bitcoin the car.

As more people come to terms with that idea, Teeka says we’ll see bitcoin’s price soar.

That’s why he’s urging his readers to rewire their portfolios…

— RECOMMENDED —

Stansberry’s NEXT Big Crypto Prediction

Stansberry’s NEXT Big Crypto Prediction

As bitcoin’s value continues to soar and the government keeps printing dollars, cryptocurrency expert Eric Wade is back with what could be our biggest moneymaking prediction this year. The last time Eric held an event like this, he urged you to buy bitcoin just before it soared over 400% in only seven months. Now, he’s revealing what’s NEXT… including six tiny cryptos floating under the radar that could 10 times your money in 2021.

What’s Teeka Tiwari’s Latest Recommendation?

In the past, Teeka recommended his readers have no more than 2% of their portfolios in cryptos, including bitcoin… and no more than 10% in precious metals, including gold.

Now, he recommends putting up to 10% of your portfolio in bitcoin alone… up to 2% in other cryptos… and up to 1% in gold.

As he explains it…

I believe bitcoin and other cryptocurrencies are doing a far better job than gold in protecting wealth – and will continue to do so. I also believe bitcoin and other cryptos will benefit from new tremendous demand as the rest of the world wakes up to the same realization.

Now, am I saying this means you should sell every piece of precious metal you own? No. A small allocation to gold still makes sense as “end of the world” protection – say, in the event of a complete power grid failure or something else equally catastrophic.

But I believe it’s critical you have a much larger stake in bitcoin and maintain exposure to other cryptos. If that means taking money out of gold, so be it.

For example, if you have 10% of your assets in gold and just 1% in bitcoin, Teeka recommends you reduce your gold allocation to 1%… and up your bitcoin allocation to 10%.

And don’t worry that bitcoin now appears “expensive” at around $56,000. As Teeka says, he believes we’ll see $500,000 bitcoin within five years.

— RECOMMENDED —

Where is bitcoin headed over the next few months?

Where is bitcoin headed over the next few months?

Bitcoin is hitting record highs. Should you buy, sell, hold on for dear life? Matt McCall just gave the full details on where he believes the crypto markets are headed in a recent special presentation.

You can watch the replay here.

Crypto’s Next Trillion Dollar Coin Portfolio

Teeka Tiwari is a world-renowned crypto expert. But he hasn’t always been acclaimed. He was a laughingstock when he first recommended bitcoin to his subscribers in 2016. Since then, it’s up more than 12,700%.

It pays to listen to Teeka, in other words. But bitcoin isn’t the cryptocurrency Teeka is most excited about right now. He has his eye on what he believes will be crypto’s next trillion-dollar coin.

Teeka Tiwari claims that billionaires are in a frenzy buying it… The world’s largest payment networks are adopting it… And Wall Street’s most respected firms are rushing to get in.

But here’s what nobody sees… what the media isn’t reporting… and what no member of the financial elite wants you to find out…

Behind the scenes, the smart money has now begun to go all in on what Teeka considers crypto’s next trillion-dollar coin.

In 2016, Teeka recommended bitcoin, which became crypto’s first trillion-dollar coin by market cap. And on Wednesday, March 31, at 8 p.m. ET, Teeka Tiwari will reveal what he believes will be the next $1 trillion crypto for free.

Click here to sign up for the event and receive a FREE bonus that would typically cost you $2,500 to access. Then mark your calendar for March 31.

Just for attending the event, Teeka will tell you the name and ticker symbol of this coin. You don’t want to miss it.