Despite the market highs, forensic accountant Joel Litman sees trouble ahead. His data reveals a crisis could send some stocks soaring while others crash in the coming weeks. In a brand-new interview, Joel names 18 widely owned stocks you should sell immediately and the ONE group of stocks you should own with 500% upside for free.

I’ve been getting a lot of questions about Joel Litman’s latest project with Dr. David “Doc” Eifrig. This past week, they issued a major warning for 1 in 3 U.S stocks and detailed the lucrative opportunity it presents you.

Joel also made you an extraordinary offer to get his latest research at a huge discount.

To be clear, you can still claim one of the all-time BEST offers to try Joel Litman’s High Alpha research:

- 50% OFF High Alphamy premier research service offering the best smaller stock recommendations with the potential to double or five times your money.

- One year of free access to the Altimeter Pro ($1,200 value), which you can use to type over 5,000 tickers and instantly know their TRUE earning power. It can tell you which stocks have the potential to soar and which are on the verge of crashing.

- Plus additional FREE bonuses, worth thousands of dollars.

And if you act today, you’ll lock in a total bundle of $9,700 worth of software, research, and free bonuses.

But if you’re still on the fence, I took a few minutes to ask Joel to answer the most common questions they’ve received from readers which you can find below.

I hope you’ll find this helpful.

Table of Contents

- 1 What is ‘The Wall of Debt’ and ‘Strategic Acquirers’ I keep hearing about?

- 2 Will you ever recommend “Strategic Acquirers” outside of Health Care?

- 3 Will a pause or cut in interest rates impact your recommendations at all?

- 4 Are you worried about the 2024 presidential elections impacting these stock recommendations?

- 5 Are you worried regulators could disrupt the opportunities for strategic acquirers?

- 6 Should I be focusing on bonds OR stocks right now?

- 7 Will you ever recommend stocks that aren’t strategic acquirers, but are still good buying opportunities?

- 8 What are all the special bonuses I can receive today?

What is ‘The Wall of Debt’ and ‘Strategic Acquirers’ I keep hearing about?

Right now, 1 in 3 companies are facing what I call the “Wall of Debt.”

Put simply, it means a company’s debt has become so exorbitant that there’s simply no way they can be expected to service it… given how much cash they’re expected to generate.

And this dire situation is not just concentrated in one area like biotech or oil or real estate…

It’s happening in each of the 11 sectors that make up the overall stock market.

Most people don’t know all 11, but here’s the full list:

Every single sector includes dozens of companies staring at this Wall of Debt.

These companies will hemorrhage money, employees, and assets to try to keep up… and they’ll ultimately be forced to sell off things like valuable patents, equipment, office property, and even entire product lines.

You’ve probably noticed an uptick in layoffs lately?

Well, the Wall of Debt is a big reason why this is happening.

Again, we see this situation in every single sector of the market.

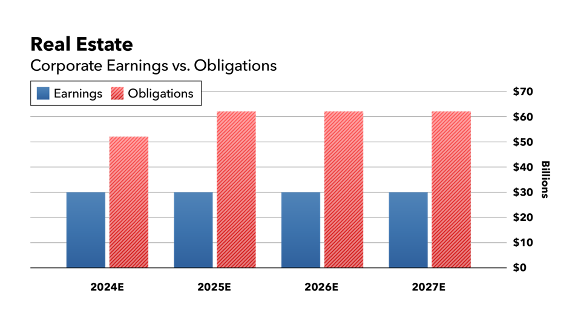

Look at real estate, as an example:

The red bars show how much debt publicly traded real estate companies owe collectively…

And the blue bars represent their estimated earnings… how much cash they expect to come through the doors.

As you can see, short of a miracle, they’ll be unable to pay their debts for years…

And if you drill down to specific companies, the situation is even more dire.

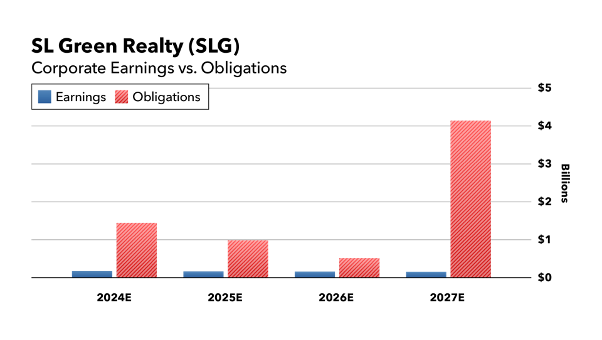

Like SL Green Realty (SLG), Manhattan’s largest office landlord – they’re in big trouble.

Real estate companies often operate on high leverage, and SL Green is no exception.

But they’re facing an insurmountable Wall of Debt – with over $5 billion in debt maturing within the next three years.

It’s shown by the red bars in this chart:

And the blue bars show their cash earnings, which, as you can see, won’t cover their debts through 2027!

SL Green is like a crash-test dummy speeding toward a brick wall – a collision is inevitable, and the impact will be disastrous.

Last summer they needed to sell assets to get a quick cash infusion ASAP…

If they didn’t, they would have fallen short of covering their debts.

So, they sold a 50% stake in their Midtown Manhattan office tower to a Japanese firm called Mori Trust:

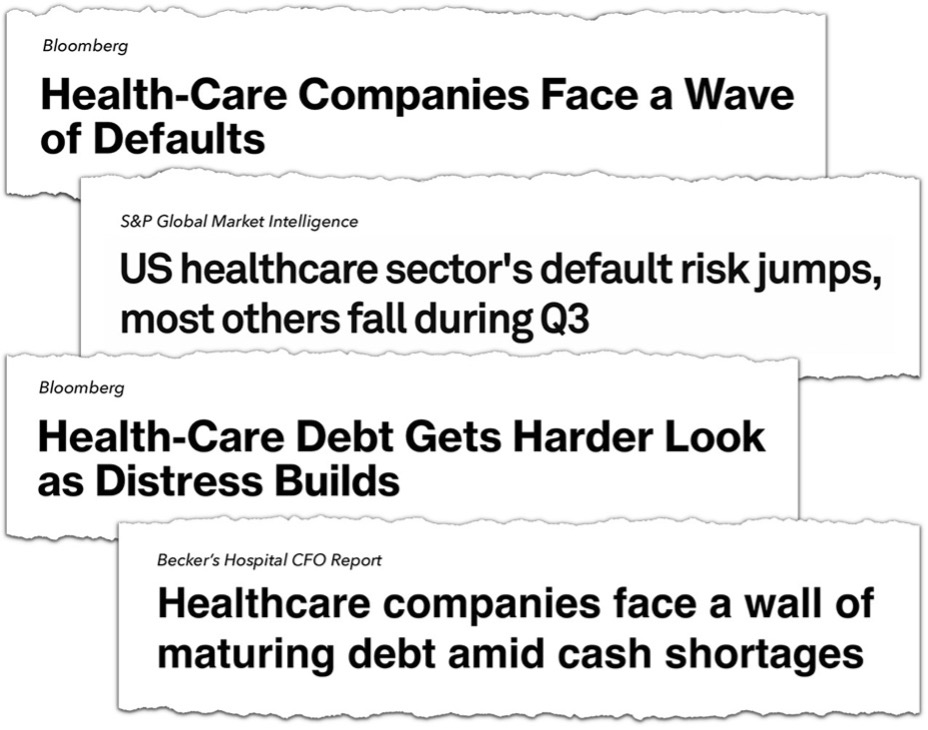

But there’s one sector we’re watching meticulously because of its Wall of Debt

This one you probably HAVE seen in the headlines: Health Care.

Our data shows 1 out of every 4 health care companies will not be able to pay their bills this year.

And that number rises to 2 out of every 5 by 2026.

It looks dreadful on a company level…

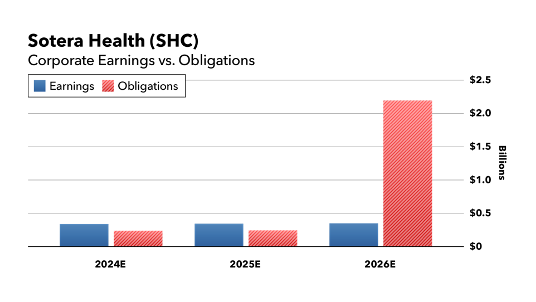

Like Sotera Health (SHC):

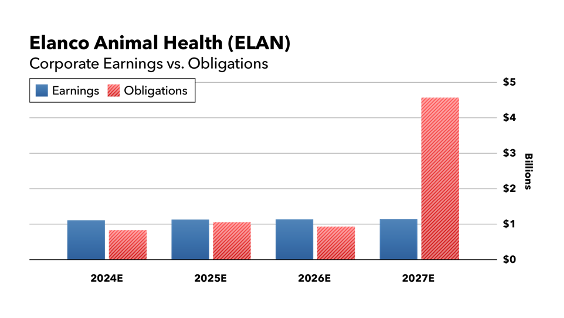

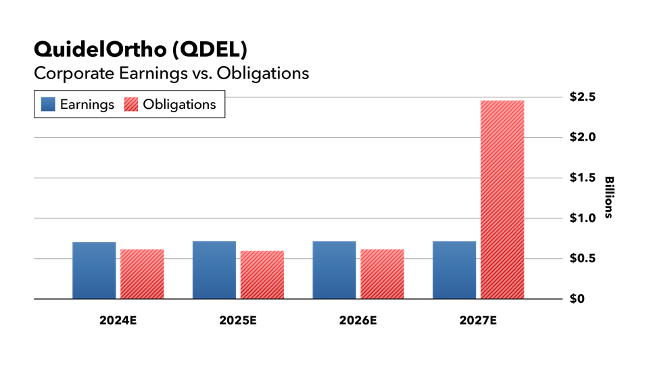

Elanco Animal Health (ELAN):

And QuidelOrtho (QDEL):

They’ll likely be forced to sell their assets if they want to meet their debt obligations.

And this is exactly why 2024 presents us with such a special investing situation.

In the world of finance, this is when you want to buy companies commonly referred to as “Strategic Acquirers.”

Doc and I are both predicting 2024 is going to be a huge year for these types of stocks, which could soar 500% or more.

And even better, this is a cycle that keeps repeating, building up value for their shareholders over many years.

That’s because after they buy a company, they typically go on to buy even more.

Mark my words: Strategic acquirers in the health care space are about to go on a buying frenzy like you’ve never seen.

Remember, my system shows you exactly how to spot opportunities like this.

And this won’t be the first time it’s spotted huge winners with strategic acquirers in the health care space with 5-10x upside.

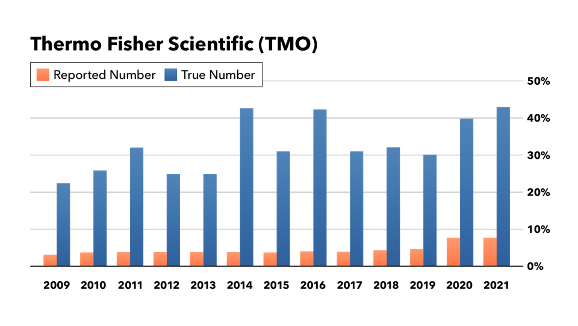

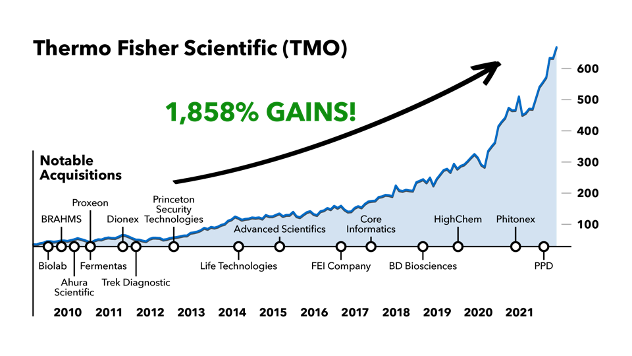

Like Thermo Fisher Scientific (TMO):

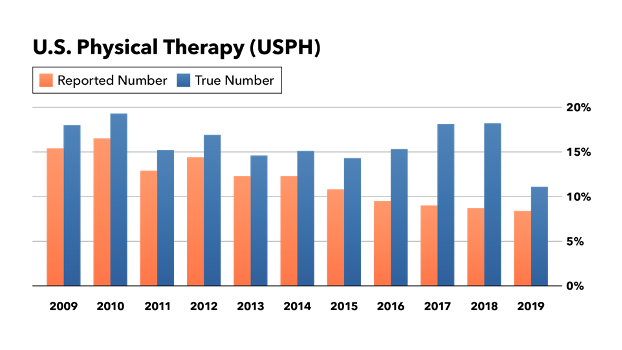

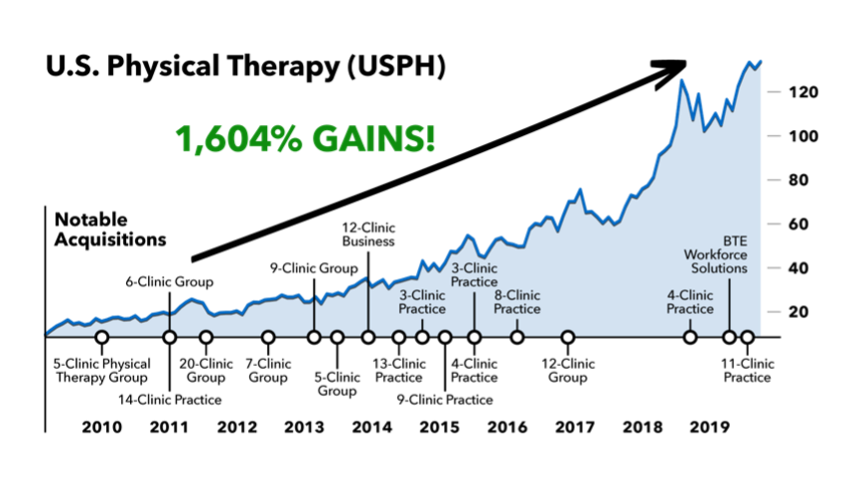

U.S. Physical Therapy (USPH):

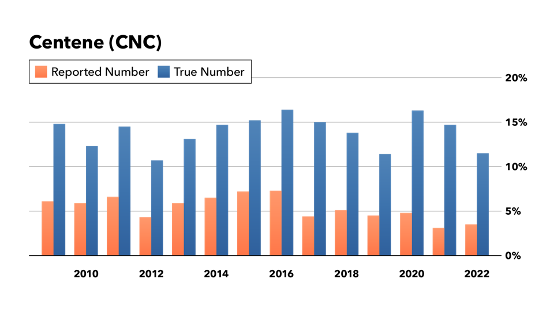

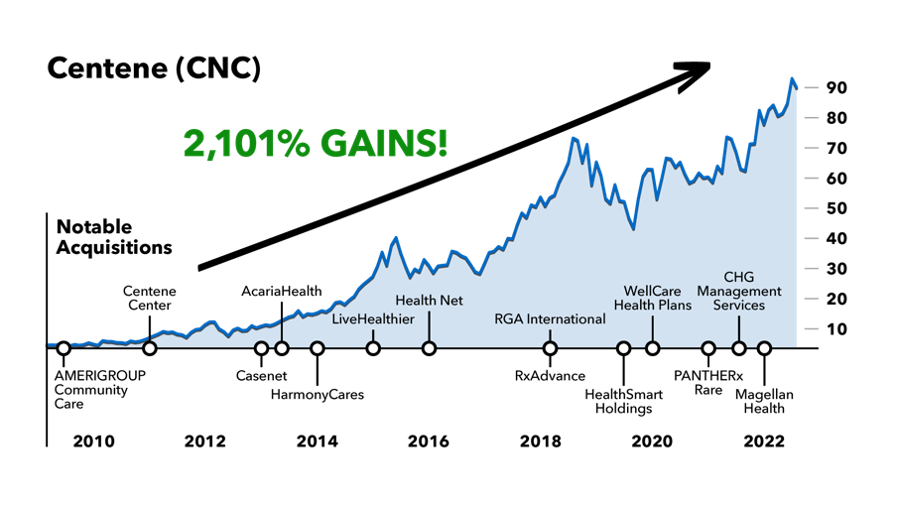

Centene (CNC):

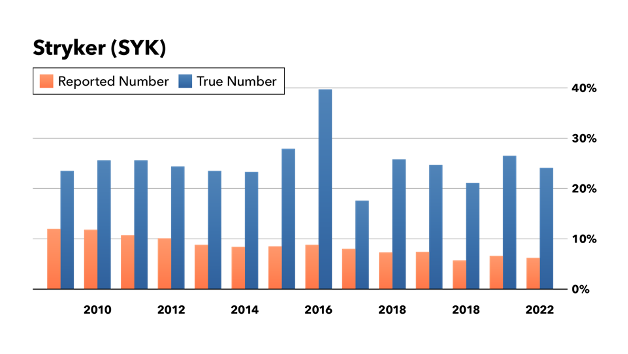

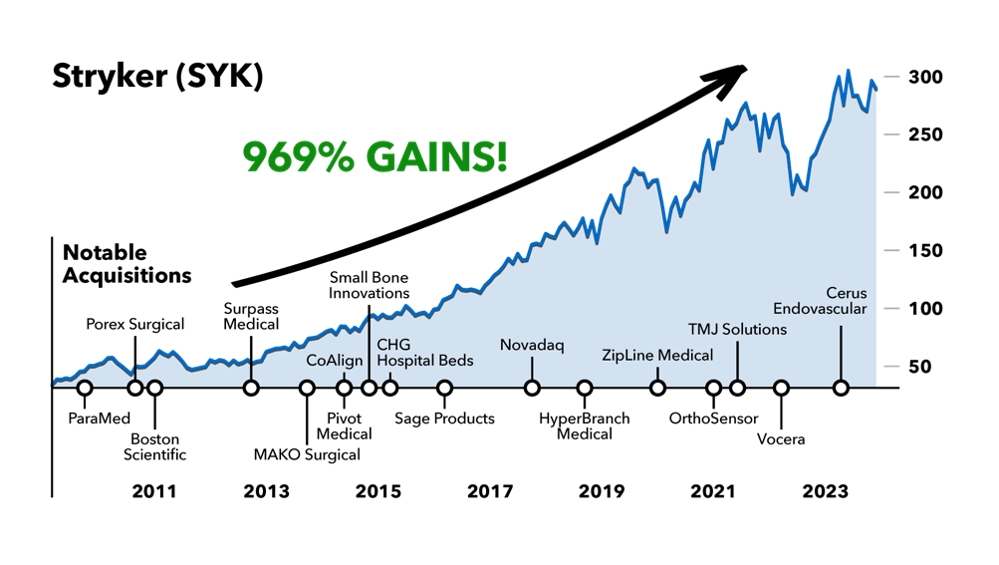

And Stryker (SYK):

This is the opportunity you have in front of you right now…

And I’ve listed my favorite companies to buy in this space today in my brand-new special report: The Health Care Market Movers With 500% Upside.

I’ll send you this report right away when you take a 30-day trial subscription to my elite research service, High Alpha.

And as a reminder, I’m still offering 50% OFF when you sign up now.

Will you ever recommend “Strategic Acquirers” outside of Health Care?

Yes! While we’re eyeing health care for some big wins in 2024, we can’t overlook opportunities in other sectors.

As I’ve shown you already, EVERY sector is facing its own debt headwalls over the next year or two.

It actually reminds me of early 2009 when I basically shouted at hedge-fund managers to own strategic acquirers… before they rocketed higher.

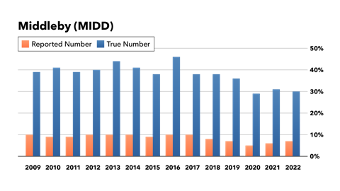

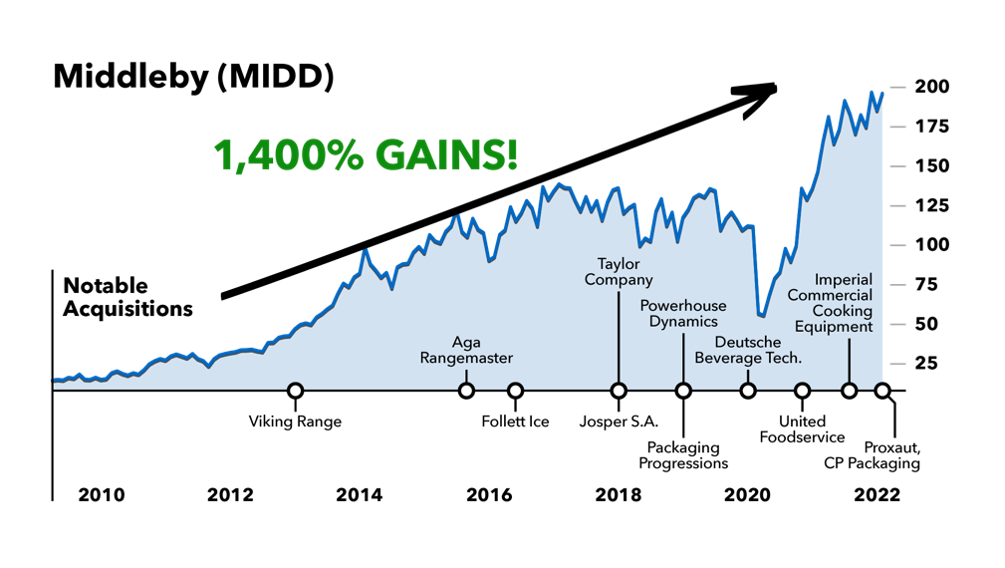

Like Middleby (MIDD), a cooking equipment manufacturer.

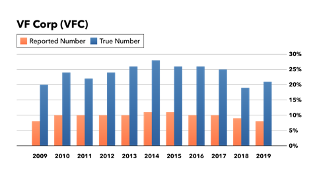

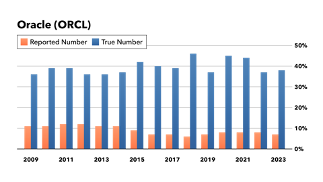

As a reminder, the blue bar shows you the potential my system saw vs. what the market saw:

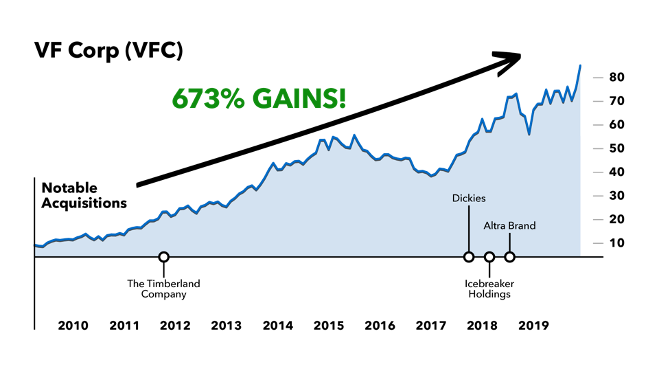

VF Corp (VFC), an apparel company:

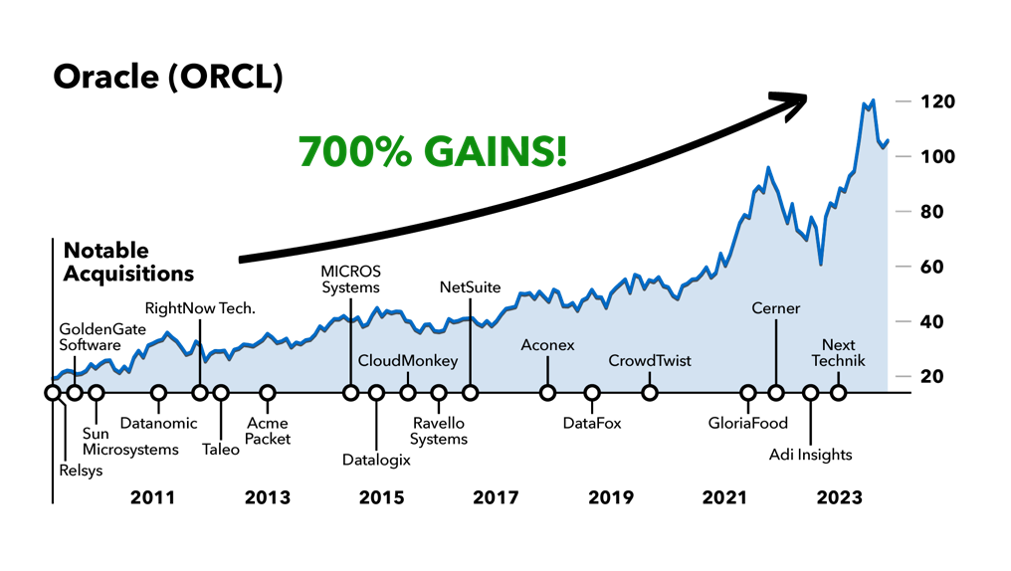

And Oracle (ORCL), a database management software company:

Unfortunately, many people chose not to listen to me… and consequently missed out on one of the biggest, lowest-risk money-making opportunities I’ve seen in my entire career.

I don’t want that to happen to you in 2024.

That’s why I’ve put together another report I’d like to send you today as well,

It’s called, Altimetry’s Top Stocks to 5x Your Money and Pay for Your Retirement.

Inside you’ll find a list of strategic acquirers across the entire market, not just health care.

You could 5x your money in just a few years with the names on this list.

Will a pause or cut in interest rates impact your recommendations at all?

Here’s the deal…

Strategic acquirers have a unique edge in high-interest-rate environments because they’ve got the cash flow to manage debt, something many companies are struggling with right now.

This means they have less competition and more chances to snap up assets at bargain prices.

Interest rates were at a 22-year high by the end of last year.

Sure, Powell mentioned lowering rates in 2024…

But he has a singular focus on making sure inflation does NOT return.

With the current low unemployment rate, expectations for rates to drop dramatically are unrealistic.

But look, even if rates are cut in half – which I doubt will happen – companies are facing massive debt headwalls.

In other words: Most companies are in a tight spot, and they’ll be forced to sell assets to raise cash.

That’s where strategic acquirers step in, ready to take advantage.

And let me be clear. Even if interest rates fall to incredibly low levels again, there are still opportunities to double your money with strategic acquirers.

Take 2020 for example…

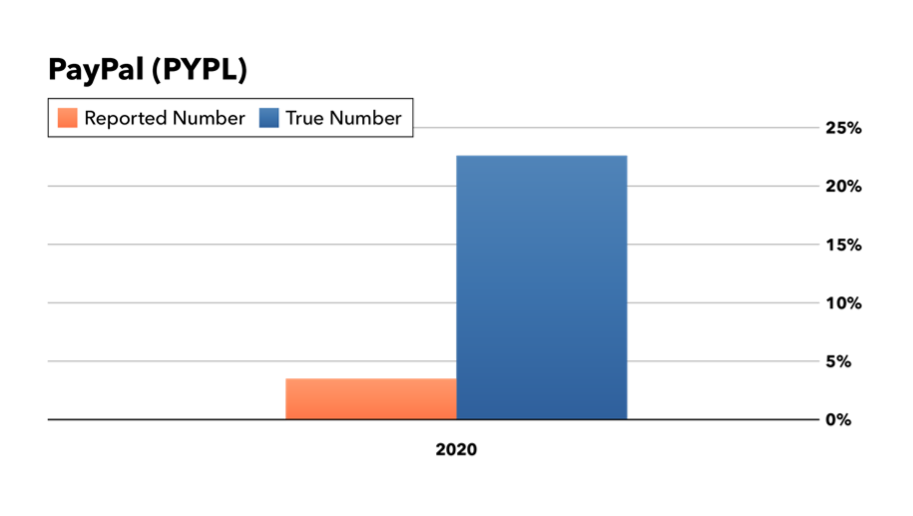

Despite historically low interest rates, the Altimeter Pro spotted PayPal (PYPL).

They had already bought over 20 companies, including Venmo, a popular mobile payment service:

We saw it had 5x more earning power than what traditional reporting saw.

And in 2020, they acquired Honey, a company that helps people save money shopping online, for $4 billion in cash.

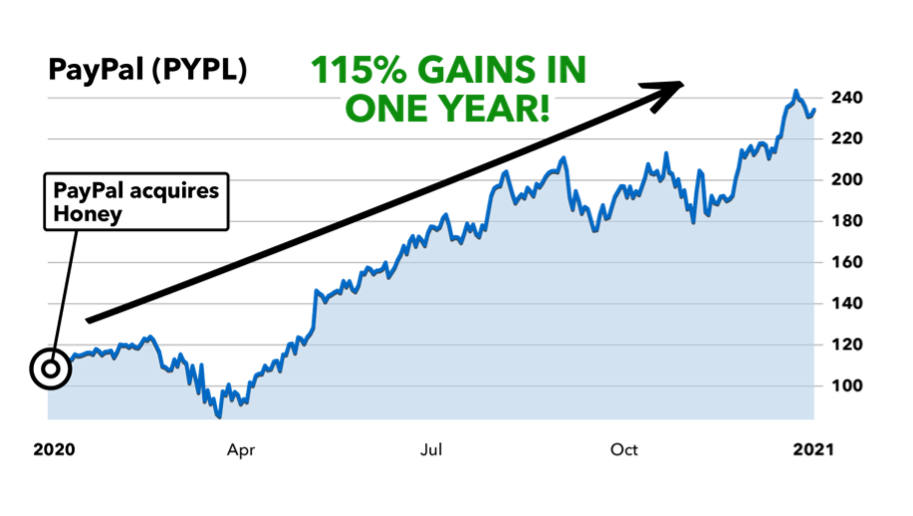

The stock surged 115% that year:

True to form, PayPal kept up its acquisition spree with four major buys in 2021.

My point is that the Fed’s actions don’t have to faze you when it comes to your financial future.

Where we’re seeing high or low interest rates, the Altimeter Pro and I can consistently guide you to the winners in the market.

Again, all my best strategic acquirer recommendations only live inside High Alpha – claim 50% off the normal price for one year of access here.

Are you worried about the 2024 presidential elections impacting these stock recommendations?

When it comes to this strategy, there’s no need to stress over the upcoming presidential election.

The performance of strategic acquirers remains strong regardless of whether it’s a Democrat or a Republican in the White House.

We just mentioned we found PayPal (PYPL) in 2020, which could’ve doubled your money – well, that happened during an election year.

Or take 2016, another election year…

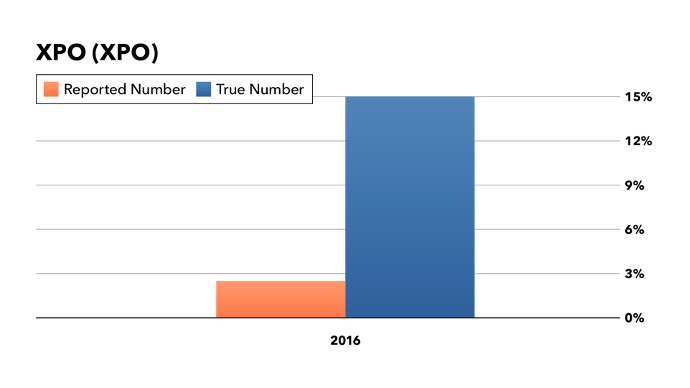

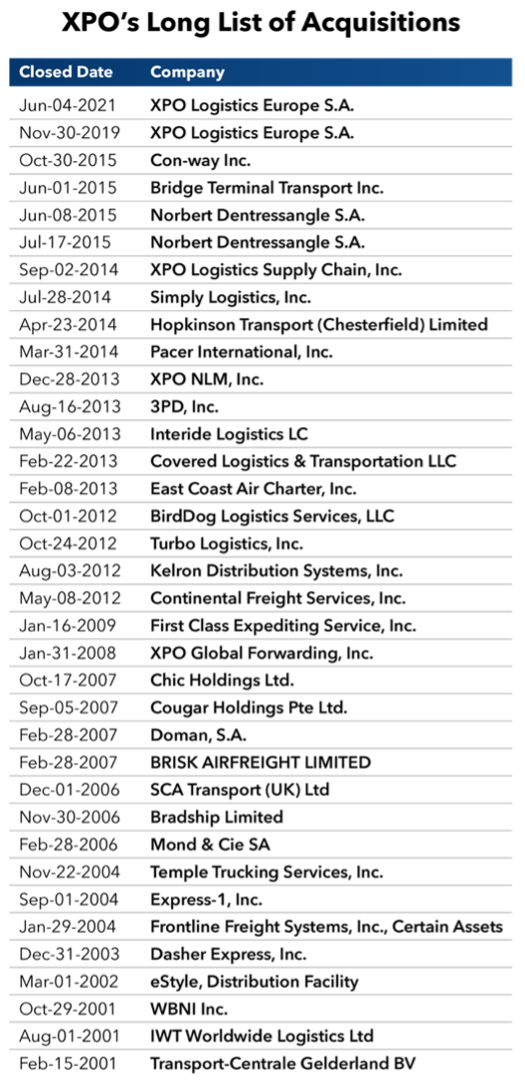

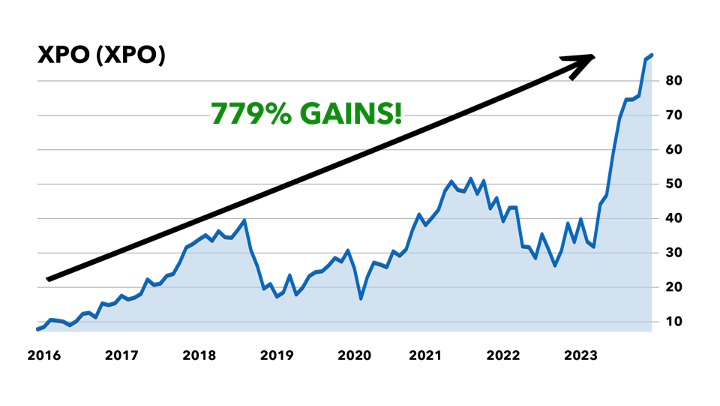

We spotted XPO (XPO), a cargo transporter:

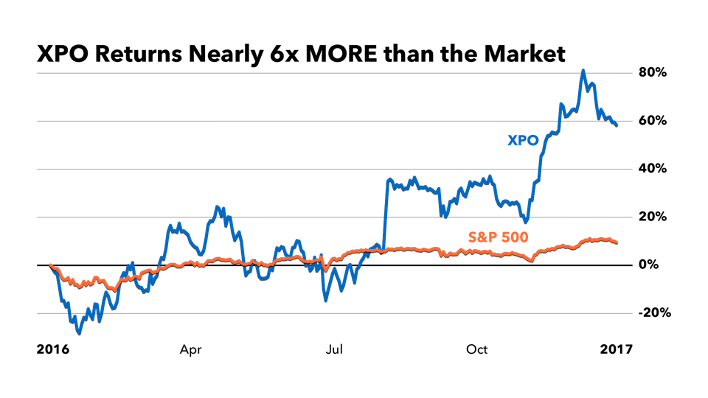

XPO outperformed the market nearly sixfold that year:

XPO has been impressive – they’ve acquired 36 companies:

And since 2016, their stock returns have skyrocketed to 779%:

So don’t let the presidential election rattle you.

With strategic acquirers, you can ignore the constant political headlines that will for sure dominate the news.

Instead, you can access Doc and I’s new strategic acquirer recommendations – including the names, tickers, and my buying instructions right now – when you become a High Alpha member for 50% OFF the normal price.

Are you worried regulators could disrupt the opportunities for strategic acquirers?

“There’s news of regulators pushing back on acquisition deals. We saw it with Microsoft buying Activision and with the recent acquisition of U.S. Steel and others. Are you worried regulators could disrupt the opportunities for strategic acquirers?”

In our presentation, Doc and I talked about AT&T’s (T) $100 billion takeover of media empire Time Warner in 2016.

Those large-scale deals are exactly the ones the government is scrutinizing for potentially stifling competition in the market.

But here’s the thing: The small strategic acquirers we’re recommending are NOT on the government’s radar.

They’re large enough to acquire smaller firms to grow…

But their deals don’t disrupt the market competition enough to raise regulatory concerns – they aren’t the government’s priority at all.

It’s why we see them as a lucrative opportunity for you to make a windfall…

Because the biggest gains often come from owning small strategic acquirers before they sprout into household names.

And our forensic accounting can help us point you to these opportunities.

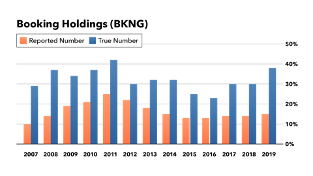

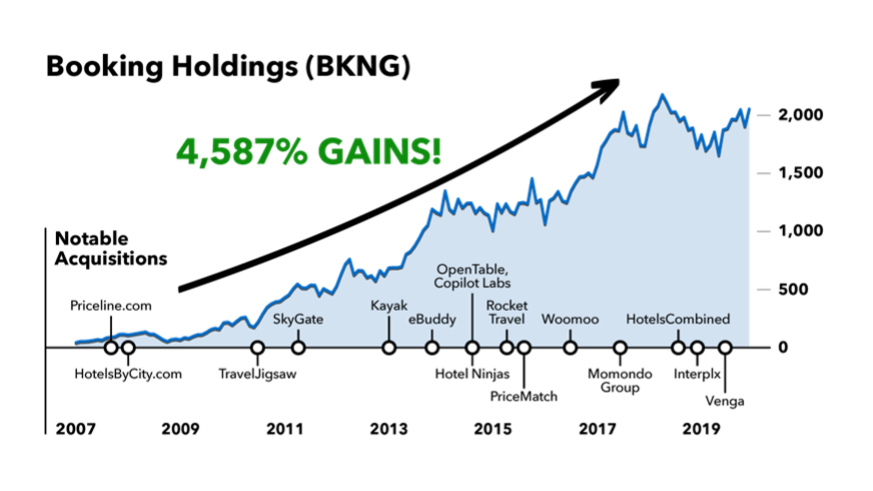

Like when we spotted Booking Holdings (BKNG) when they were just a mid-sized online travel service provider:

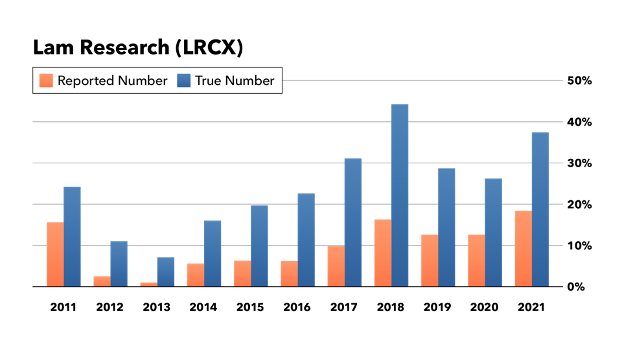

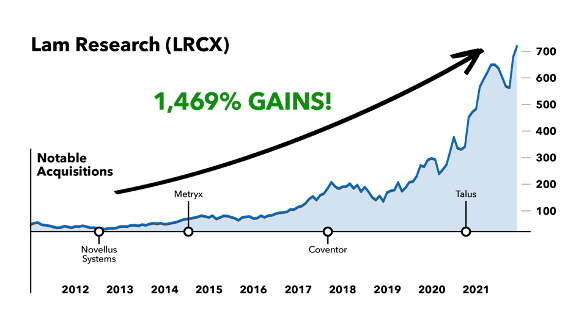

Lam Research (LRCX), before the chip shortage put them on the map:

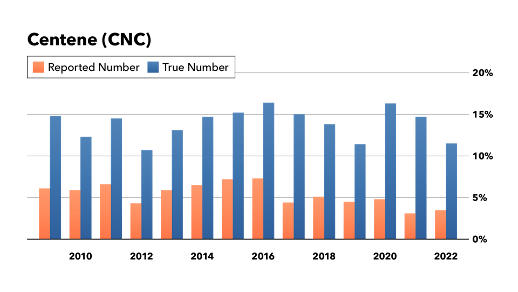

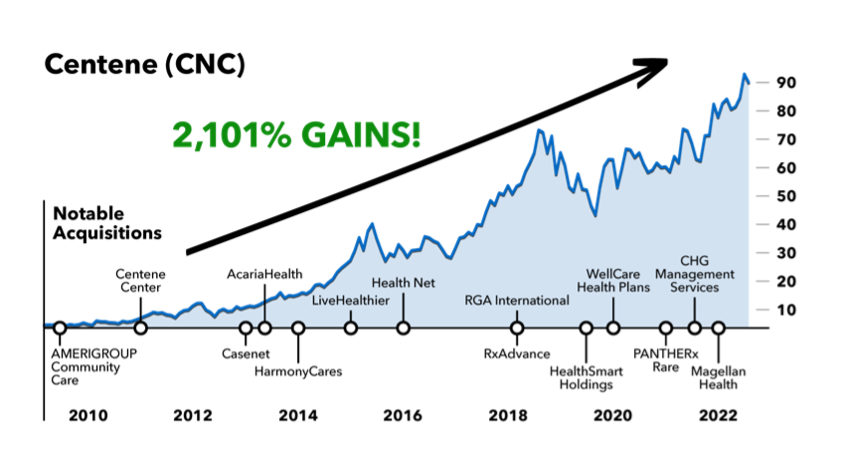

Centene (CNC):

And many others.

So no, you don’t have to worry about government regulations affecting our small strategic acquirer recommendations.

Just note: My top strategic acquirer recommendations live inside my premier research service, High Alpha. And today, you can still access it for half off, along with a bundle of other bonuses worth over $9,000.

It’s a phenomenal deal, but only available for a limited time…

Click here to get started now.

Should I be focusing on bonds OR stocks right now?

“Joel, you’ve been predicting a recession and talked a lot about bond investments recently. So, should I be focusing on bonds OR stocks right now?”

Yes, let me clarify that.

Right now, we’re bracing for a recession, which means we’re likely to see some rough patches in the stock market.

If your money is in the wrong place, it could spell trouble for your retirement.

That’s why I’m big on corporate bonds at the moment. They’re a smart bet during a credit crisis, so much so that we even just started a newsletter focused 100% on bond investing.

But my outlook is undeniably bullish in the long run. I still believe we’ll enter a new era of American dominance with our evolving technology.

So at Altimetry, we’re all about prudent positioning. Even in these tough economic times, we’ll continue to recommend certain stocks.

There are always tactical opportunities out there, and strategic acquirers are the ones we’re pounding the table on today.

These are the stocks that can pay off in a year and then really compound your wealth when held over the long term.

Couple that with the health care sector?

Your portfolio can essentially be “recession-proof”.

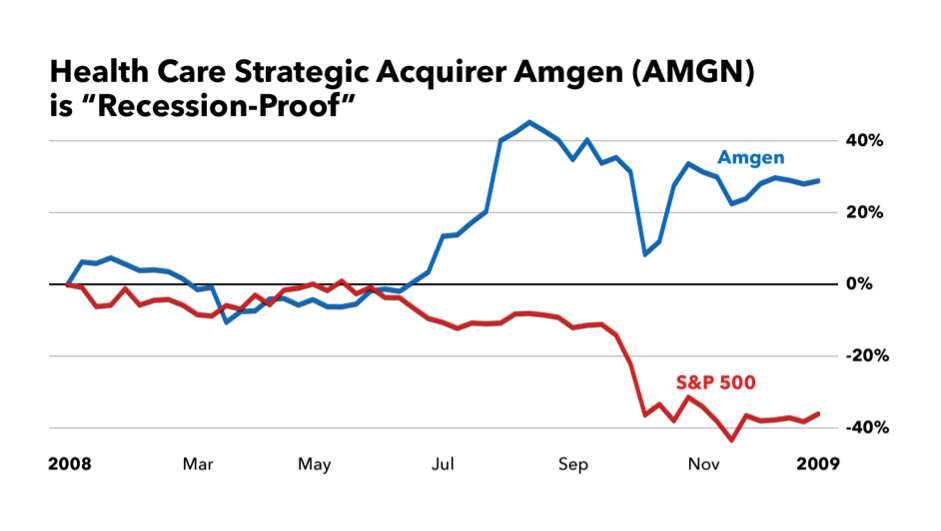

I mentioned Amgen (AMGN) earlier, but I want to drive this idea home.

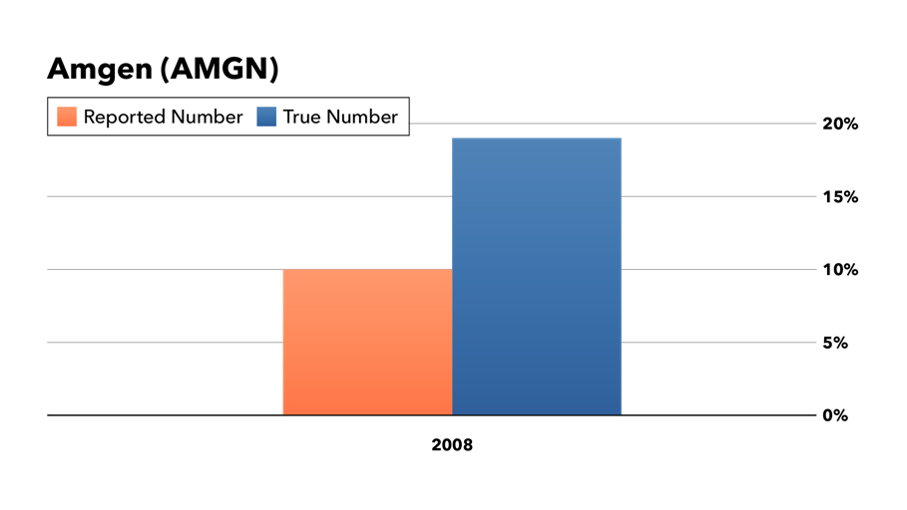

In 2008, the Altimeter Pro spotted Amgen (AMGN), a pharmaceutical strategic acquirer:

While the market crashed by the end of the year, Amgen was UP 32%!

That’s the kind of resilience strategic acquirers can offer.

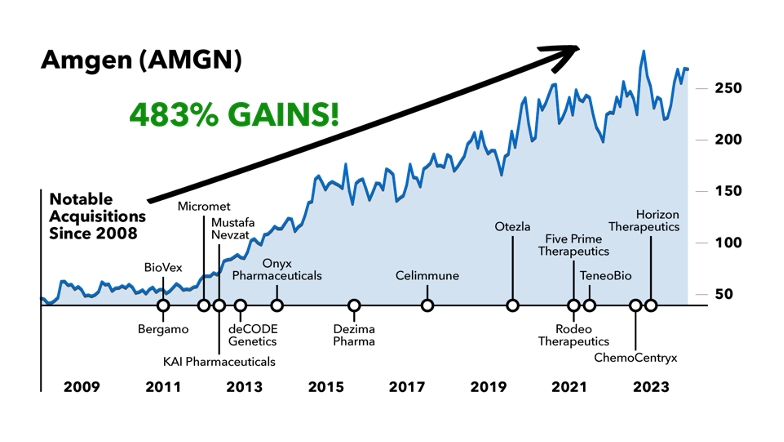

And look at Amgen now, they’ve soared 483%:

So really, there’s no need to worry about losing sleep over a market downturn when you have strategic acquirers in your portfolio.

You can still claim access to my list of top strategic acquirers and $9,700 worth of bonus research when you act today.

Click here to get started now.

Will you ever recommend stocks that aren’t strategic acquirers, but are still good buying opportunities?

Excellent question and the answer is yes.

When you take me up on today’s special offer, you’ll automatically get access to my entire model portfolio in High Alpha.

Some of these stocks are strategic acquirers, and some are a different class altogether.

Buh what they all have in common is they’re smaller stocks with huge distortions in the Altimeter Pro.

So, I recommend you start with my new list of strategic acquirers. They’re the most time-sensitive.

But we’ll also have plenty of other opportunities to show you over the next 12 months.

Really, the beauty of the Altimeter Pro is you just never know what undervalued stock it’s going to uncover next.

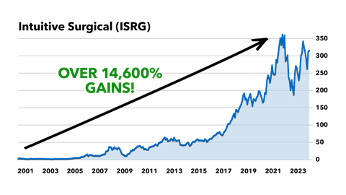

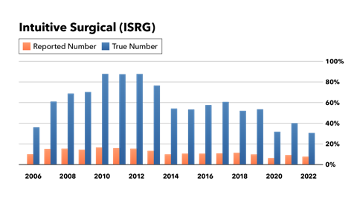

Like Intuitive Surgical (ISRG)…

It’s soared over 14,600% since it invented a robotic surgeon called the da Vinci system:

You may have heard of it or even recognize it in the image below…

Despite its phenomenal growth, its traditional accounting metrics have been extremely poor every single step of the way to that 100-bagger.

But as usual, forensic accounting told a very different story… the TRUE story:

It would have caught onto ISRG in 2006, when it was still a mid-sized company.

And that could have turned a single $5,000 investment into more than $105,000 today.

It’s now a multibillion-dollar stock!

I can’t stress this enough: Most people think accounting is a snooze…

But do you really mind being bored if you could use it to find overlooked opportunities that could 5x your money or more?

It can be your secret weapon to uncover a small anomaly in a company’s financials that could lead to monumental profits.

Some analysts believe that ISRG could be a trillion-dollar stock in the next twenty years.

But the Altimeter Pro found it first.

And you can get one year of FREE access to the Altimeter Pro ($1,200 value) when you become a High Alpha member today.

Click here to get started now.

What are all the special bonuses I can receive today?

I want to give you everything you could possibly need to grow your wealth this year… as you’re about to see some industry-changing acquisitions as 1 in 3 U.S. stocks struggle to manage their crippling debt.

So, I’m still including eight additional FREE bonuses when you claim your extraordinary 50% discount.

Here’s everything you’ll receive if you act now:

- 50% OFF of High Alpha

- BONUS: The Health Care Market Movers With 500% Upside

- BONUS: Altimetry’s Top Stocks to 5x Your Money and Pay for Your Retirement

- 1 FREE YEAR of ACCESS to the Altimeter Pro ($1,200 value)

- BONUS: The Buyout Blacklist

- BONUS: The No.1 Health Care Takeover Target

- BONUS:VIP All-Access Pass ($2,500 value)

- BONUS: Health & Wealth Bulletin

- PLUS: Your surprise MYSTERY GIFT ($1,000 value, more details here)

And it’s all backed by our 100% Satisfaction Guarantee, so you can get a FULL credit refund on your subscription any time for the next thirty days – which you can apply to any current or future product from Altimetry or Stansberry Research.