If you are wondering what should you do with your money in the current economy, Stansberry Research has a solution. They recently launched a new promotion of their monthly advisory called Stansberry Venture Value.

It takes both venture-capital and value approaches to investing. Editor Bryan Beach uses these proven strategies to pinpoint companies that are overlooked by the market for various reasons. Because they are “too small” or “too boring”.

Not sure Stansberry Venture Value is for you? Read further to learn more details about how it works and how to benefit from it.

Table of Contents

- 1 How Stansberry Venture Value Can Help You Overcome the Market Blind Spots?

- 2 How To Be Sure These Gains Are On The Way?

- 3 Bryan Beach Stansberry Venture Value Companies With Blind Spots

- 4 When The Rebound Will Happen?

- 5 Who is Bryan Beach?

- 6 Bryan Beach’s Small Cap Stocks Recommendation

- 7 What is Stansberry Venture Value?

- 8 How Much Is Stansberry Venture Value?

- 9 What Is Included with your Stansberry Venture Value Subscription?

- 10 Final Words

How Stansberry Venture Value Can Help You Overcome the Market Blind Spots?

Special guests at the presentation were Marc Chaikin (Founder of Chaikin Analytics) and Stansberry Research’s Bryan Beach. They were talking about one of these blind spots that are affecting a significant portion of the market right now. It may very well determine the course of your money for the next decade or more.

Blind Spots frequently occur at critical moments when the opportunity for massive benefits emerge. And, as you might expect from their name, they affect investors’ ability see a major trend in the market or notice a particular stock that is about to soar.

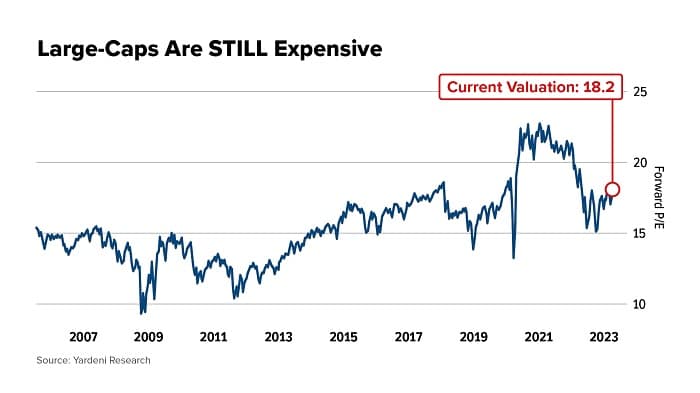

Bryan’s recent analysis are showing that big name stocks are MORE expensive right now than they were in 2018, when the bull market was still raging! Prices have dropped, but they were so expensive to begin with that we aren’t seeing any real reductions right now… At least not on a big market scale.

If you’re searching for a good buy right now, there’s ONE place to look…Here is the chart:

As you can see small cap stocks are currently trading at the LOWEST values in nearly 15 years, following the depths of the 2008 financial crisis.

And when you compare them to large caps, they’re significantly cheaper.

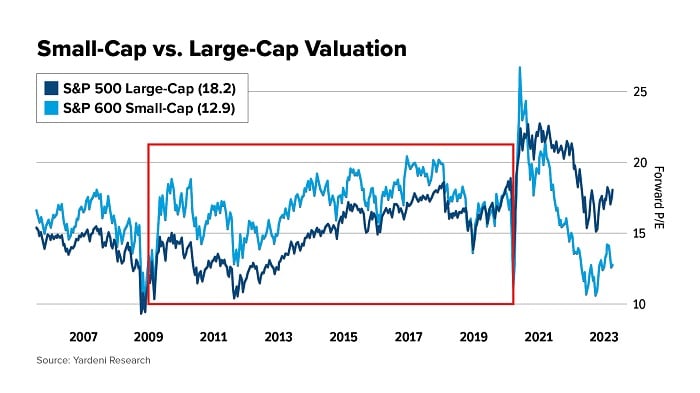

Look at the next one… except for right around the Covid crash in early 2020, small caps had been trading HIGHER than large caps pretty much for an entire decade.

It makes sense. We were in a record long bull market from 2009 through March 2020.

And when investors are eager about expansion, they will pay a higher price for a smaller company with more… space to grow. So, until mid-2021, small cap companies had been the most profitable stocks on the market for a decade.

Now, just two years later, they’re as inexpensive as they were during the worst economic downturns in the previous 15 years. We’re in a bear market and investors just aren’t going to take a chance on a smaller, more speculative company.

Bryan summaries it: The reality is, many of these companies are VERY healthy businesses with great financials, dynamic products, and strong management teams. You just wouldn’t know it by their current share prices.

How To Be Sure These Gains Are On The Way?

Most economists believe we formally entered a bear market in 2022… and we have yet to emerge from it. But here’s what many people don’t realize…

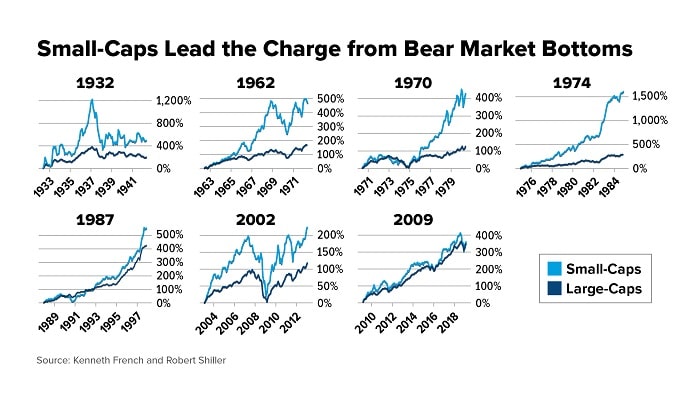

Based on his experience, Bryan noticed that stocks rebound 43% on average in the first year after a bad market. Small caps lead the charge during those times, with the BIGGEST and FASTEST gains.

Take a look at seven of the biggest bear markets of the last century and you’ll see for yourself.

EVERY time stocks emerge from the bottom of a bear market; small caps have always outpaced large caps? Small caps have historically returned an amazing 70% on average in the year after a bear market or recession. This is 11% higher than large caps.

And the greatest outperformance occurs in the first three months…

Bottom line: Bryan Beach’s advice is that “NOW is the time to be buying small caps, before that potential price explosion hits and while they’re still offering the BEST value we’ve seen since 2009.”

He has a list of the top small caps he’s especially bullish on right now… and each of them have the potential to double or perhaps even triple your money in as little as 18 months.

Bryan Beach Stansberry Venture Value Companies With Blind Spots

During his research, Bryan most often finds profitable blind spots in companies that in general have few characteristics:

- A tiny market cap (usually less than $500 million)

- Collections of different businesses or assets

- Very little coverage from Wall Street analysts

- A future catalyst with the potential to unlock hidden value.

Keep in mind that not ALL small caps are good investments. And certainly not all of them have a blind spot.

Bryan doesn’t consider companies with hairbrained businesses. He also usually stays away from recommending startups that don’t yet generate revenue.

You could make money with those speculations, but that’s not his specialty.

In general, he is looking for the kind of business he’d want to put his own money into. Meaning small… capital efficient… growing… and a lot of times, in so-called “boring” industry… like insurance stocks!

When The Rebound Will Happen?

Timing the market is extremely hard because it is based on so many variables that we cannot begin to predict.

But the types of opportunities Bryan and his team find with Stansberry Venture Value are cash-producing businesses that he believes are going to outperform over the long haul even if you don’t time your entry perfectly.

Marc Chaikin shared that even he looks forward to reading Bryan’s analysis every month because he almost every time learns something new.

Who is Bryan Beach?

Prior to joining Stansberry, Bryan worked as an auditor for one of the Big Four accounting companies beginning in 1998.

He also worked as a controller for a publicly traded company, where he oversaw a team of accountants responsible for closely monitoring the company’s financial health and issuing SEC financial statements.

He believes that all those years of poring over dense, complicated, corporate financial statements is what’s given him the ability to see those “blind spots” that almost no one in the investing world understands.

Bryan Beach’s Small Cap Stocks Recommendation

Bryan shared that he has spent weeks combing through the financial statements of countless companies, searching for blind spots the market’s failed to notice. He ended up narrowing it down to a small list.

To make it as simple as possible for anyone to get the info on these trade recommendations, Bryan put together a FREE report that details his favorite “blind spot” stocks right now. It’s called Breaking Past the Blind Spot: The Top Overlooked Stocks with Triple Digit Profit Potential.

It contains Bryan’s in-depth write-up on each company, the names, ticker symbols, and what price you should buy up to.

One of them is a small company that’s revolutionizing the drug development industry. It is helping to get new products out on the market easier and faster, avoiding FDA’s long approval process. There’s a huge demand for their services.

What Bryan likes about this stock is that it has the potential to be a constant wealth builder that you could keep in your portfolio for years. And you don’t have to take on as much risk as you would if you invested directly in a pharmaceutical company.

According to his calculations, the company’s service output will more than quadruple in 2023… but the stock is still trading for significantly less than its 2021 share values.

Another “blind spot” stock is Hagerty (HGTY). Hagerty describes itself as a “automotive lifestyle brand,” with a focus on automobile collectors.

It has a subscription-based automobile club with over 1.3 million paying members that offers benefits such as roadside assistance and the Hagerty Drivers Club magazine…

Thousands of collector events are also sponsored by Hagerty. Its YouTube channel has 2.5 million subscribers and videos that have been seen approximately 500 million times. But at its heart Hagerty is a boring old insurance company. It’s a young public company, but it’s already one of the most interesting investing setups.

Bryan thinks we could easily see Hagerty’s share price double within the next two years. Keep in mind that Hagerty is not a very liquid stock. So, take your time, use limit orders, and don’t pay more than $9.50 per share.

Bottom Line: Bryan and his crew have spent hundreds of hours going over financial accounts and analyzing data from various firms in order to uncover these hidden opportunities. You can also get access to their work. Here is how:

What is Stansberry Venture Value?

Stansberry Research’s founder saw Venture Value as the conclusion of everything he’d learned about the market over the previous 20 years.

And he personally chose Bryan to take over as CEO in 2017. Since then, he’s demonstrated readers how to make fast-moving, risk-averse profits of up to 247% in as little as six months.

That track record is why access to Venture Value normally costs $5,500 for a single year. With current promotion Bryan makes his research FAR more accessible than it’s ever been before.

How Much Is Stansberry Venture Value?

This is an extraordinary one-time-only offer for you to join Stansberry Venture Value at a fraction of the usual price. If you decide to join now, you’ll pay just $2,000 for access to Bryan Beach’s highest-level research for a FULL year.

You will also get an additional 12 months of Venture Value… ABSOLUTELY FREE.

Even though there are no cash refunds, if you are not satisfied with your subscription, give them a call, and you will receive full refund in form of Stansberry Research Credit.

What Is Included with your Stansberry Venture Value Subscription?

This offer includes $13,499 worth of research, recommendations, and free bonuses – all for an 85% OFF discount. Here is the list:

- 64% OFF 1 year of Stansberry Venture Value ($5,500 value)

- FREE BONUS YEAR of Stansberry Venture Value ($5,500 value)

- INSTANT ACCESS to Bryan’s model portfolio with his list of the best, under-the-radar ‘blind spot’ opportunities for 2023 (100% – 1,000%+ upside)

- FREE BONUS REPORT: Breaking Past the Blind Spot: The Most Overlooked Stocks with Triple Digit Profit Potential. As small caps continue to offer the best value we’ve seen since 2009, opportunities included in this report could outperform the market with triple-digit gains in the coming months.

- FREE BONUS REPORT: SPAC Diamonds: Mining the Darkest Corner of the Market. Bryan has spent the last few years scouring the SPAC sector and has carefully built a basket of handpicked, undervalued SPAC stocks. With the rest of the market now ignoring SPACs, these companies could offer returns of up to 1,000%. This means that one report alone could pay for my whole membership Several times over.

- FREE BONUS: The Stansberry Venture Value Handbook. This guidebook will help you get up and running smoothly.

- FREE BONUS: Bryan’s full presentation “Microcaps: A Sector Review” from our exclusive members-only investment conference ($2,499 value). You’ll discover where microcaps fit in the market right now and where they might go in the near future. PLUS: Bryan shares four significant market segments and three small companies that he has placed on his Venture Value watchlist as potential future trade recommendations.

- And more! (see below)

Final Words

Bryan Beach and his team are not guessing. They are recommending companies with real, tangible assets… brands… demand backlogs.

Businesses that, in some situations, you could liquidate and wind up with more than the share price the market is assigning.

And you may invest in these companies for $5 or $10, knowing that not long ago the market was willing to spend $20 for them.

You could use small cap strategy and buy a small cap ETF but you could get MUCH higher returns and with considerably less risk by going with individual stocks that are recommended by Venture Value team instead.

Ready To Try Stansberry Venture Value? Click Here for the best price