It’s a tall task to put a future value on bitcoin. Today I’ll show you Bitcoin’s Most Important Chart. It doesn’t come with a price forecast. But it does plot bitcoin’s future direction.

By Grant Wasylik, analyst, Palm Beach Daily

It’s a tall task to put a future value on bitcoin.

Why?

Old school valuation methods don’t work for bitcoin and other cryptos.

Ratios like price-to-earnings, price-to-sales, and price-to-cash flow are irrelevant. Unlike companies in the stock market, bitcoin doesn’t produce revenues, earnings, or cash flows.

Now, that doesn’t stop investors from trying to peg a future price. There are alternative methods – different than how we value traditional assets – to attempt to value bitcoin.

We’ve done it in Palm Beach Daily. In May, we walked you through four different valuation models: exponential price growth trend, Metcalfe’s Law, stock-to-flow ratio, and gold-to-bitcoin ratio.

Each of those four charts predicts bitcoin will hit at least $100,000 by the end of 2021.

Today, I’ll show you a different chart. It doesn’t come with a price forecast. But it does plot bitcoin’s future direction.

— RECOMMENDED —

NEW TECH TO CREATE 818,000 NEW AMERICAN MILLIONAIRES

One alarming new tech will bring about the biggest wealth shift in U.S. history.

Millionaire investing guru urges retirees NOT to be left behind…

Table of Contents

Bitcoin’s Most Important Chart

A little more than a month ago, I traveled to Orlando for a Bitcoin & Blockchain Educational Class & Luncheon via a special invitation.

Brian Estes (CIO – Off the Chain Capital), Perianne Boring (Founder & President – Chamber of Digital Commerce), and Tim Keefe (Partner – LedgerStat Capital) hosted the event.

America’s #1 tech investor uncovers the breakthrough of the century…

America’s #1 tech investor uncovers the breakthrough of the century…

For about two hours, these three renowned experts lectured a sold-out audience of 40 attendees. They covered everything from the history of money to blockchain basics to why bitcoin belongs in a diversified investment portfolio.

I learned several things at this event. But my greatest takeaway came from one chart.

Here it is:

Source: Off the Chain Capital

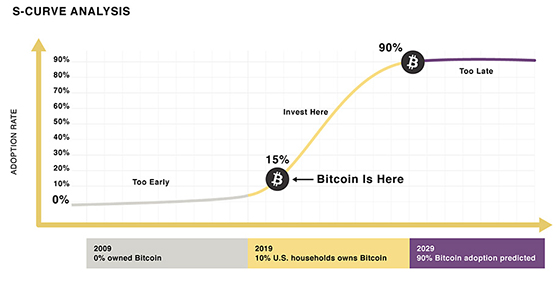

S-Curve analysis explores the adoption path of new technologies. It shows the time it takes for a new technology to go from 0% to 10% adoption is the same time it takes it to go from 10% to 90% adoption.

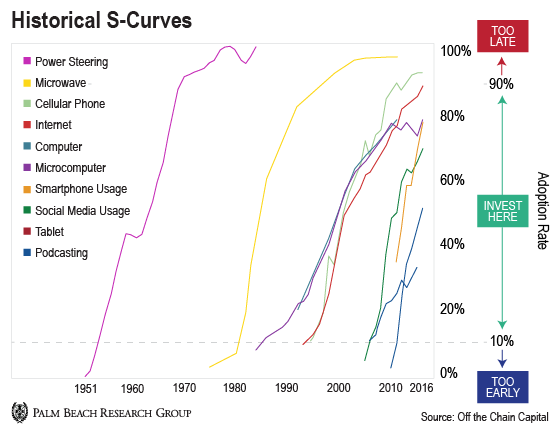

You can see what I’m talking about in this second chart, which shows the S-curve for various other technologies…

New technologies, such as bitcoin, can be valued by the “network effect.” What this means is that adding new users to a network results in its exponential gains in value.

Think about computers. Apple invented the personal computer (PC) in 1977. In 1980, about one-tenth of 1% of households owned a PC.

So, let’s use 1980 as the start of the PC revolution. By 1990, 10% of households owned PCs. And in 2000, 90% of households had a PC. So it took 10 years to go from 0% to 10% adoption, and 10 years to go from 10% to 90% adoption.

If you invested in the 10–90% area, you invested in companies like Dell, Microsoft, Intel, etc. From 1990–2000, Dell was up 88,918%… Microsoft was up 9,562%… and Intel was up 3,788%. Early S-curve investors made a lot of money.

Bitcoin is on the same path…

— RECOMMENDED —

The Best (and Worst) Stocks in America

“I’ll Show You What to Buy, What to Sell, and Exactly HOW to Do It with Less than $500”

Back in 2016, few believed bitcoin was a viable long-term investment. It was called a fad and a fraud, and some even dismissed it as a currency for criminals. But we knew they were off the mark.

At that same time, we were telling readers to get in early… that the naysayers were wrong and bitcoin adoption would explode. And we were right.

Investors who took our advice at that time made life-changing gains. They turned $500 into $14,982 by 2019… $1,000 into $29,964… gains of nearly 3000%. And all occurred in the “too early” stage, when only about 10% of households owned the currency.

America’s #1 Stock Picker Reveals Next 1,000% Winner (free)

America’s #1 Stock Picker Reveals Next 1,000% Winner (free)

Today, about 15% of households own bitcoin. So if its growth trajectory is akin to the internet, cell phone, and microwave, then 90% of households will own bitcoin by 2029.

Bitcoin is at $11,000–$12,000 today because only 100–200 million people are using it. In 10 years, when billions of people are using bitcoin, its value will be exponentially greater.

But by then, the biggest gains will be gone.

It’s Not Too Late

Time is the key variable in investing.

The S-curve is a proven method to know when to get on the train and when to get off. And the most significant gains on the S-curve are between 10% and 90% adoption.

Right now, bitcoin’s adoption rate is 15%. It’s still early in the cycle. You still have time to get on the train.

— RECOMMENDED —

You’ve heard it all before…

Go to school. Get a decent job. Work hard for years. Buy and hold stocks.

That’s the HARD way to get rich.

But this 5-Minute Secret can help you make an extra $1,400… $5,420… $7,470… in a matter of weeks.

And you can do it from the comfort of your own home in as little as 5 minutes a week…

But bitcoin adoption is swiftly accelerating. Wall Street has started to ante up. Hedge fund managers, large custodians, publicly traded companies, and wealth management firms are buying bitcoin. And more retail investors are buying, too.

That’s why it’s so important to get in at the early part of the S-Curve.

And getting in early is something Teeka told readers about way back in 2018:

The adoption of the crypto asset class by hundreds of millions of traditional investors is about to take a gigantic leap forward…

Those who position themselves now before this onrush of new investors will be in place to make truly life-changing wealth.

Remember, bitcoin has a fixed supply. With fixed supply and increased demand, prices have nowhere to go but up.

But bitcoin’s price won’t go up forever. It will go up as the adoption cycle moves to 90%… And after that, it’ll be too late.

If you don’t own bitcoin, act now.

Be responsible and start with a small stake of 1–2%. Put it away for the long term. And wait for adoption to spike.

— RECOMMENDED —

You Could Make 843% in Your Sleep From 24-Hour Trades

You could have massive overnight gains throughout this entire crisis.

“Blitz Tracker” shrinks your exposure by controlling your time spent in the market and regularly delivers powerful 24-hour gains.

Click HERE now to see how to join folks already making money during this market chaos

As I mentioned above, the S-curve method tells us bitcoin – and crypto – adoption will skyrocket over the coming months. And Teeka believes it’ll spark a once-in-a-lifetime opportunity…

Because of its underlying blockchain technology, he’s also convinced we’re about to see the biggest wealth and power shift in U.S. history.

According to Teeka, those who take the right steps now could fantastically grow their wealth… Those who don’t will be left behind.

He put together this new presentation to explain all the details…