GREAT NEWS – Teeka Tiwari and his team have made a last-minute decision to open up Palm Beach Confidential this month with a LIVE Crypto Webinar on March 14th.

“Bitcoin could be worth $500,000. Or it could be worth nothing.”

Teeka here…

I hear this argument a lot.

Today, I want to introduce you to my right-hand man and lead analyst, Greg Wilson.

Greg will give you a level-headed analysis for why we think $10,000 per Bitcoin is a conservative estimate.

Three Reasons Why Bitcoin Could Reach $10,000 (or More)

By Greg Wilson

Tim Draper knows how to make money off Bitcoin…

Draper is one of the most successful venture capitalists in the world. In 2015, the World Entrepreneurship Forum named him “Entrepreneur for the World.”

He once had a 10% stake in the video and text messaging application Skype. In 2005, eBay bought Skype for $2.5 billion. (Microsoft later bought Skype in 2011 for $8.5 billion.)

But his wildest investment came in 2014.

That’s when he bought 30,000 bitcoins at an auction held by the U.S. Marshals Service.

The bitcoins were seized by federal authorities from a black market website shut down by the FBI.

The value of the digital currency spiked immediately after the sale… And the 30,000 lot was worth more than $19 million around the end of the auction.

To date, he’s already made $112 million on that investment.

Few have profited more from Bitcoin and its underlying blockchain technology than Draper. In the last three years, he’s made several investments in blockchain startups.

So when he predicted Bitcoin would reach $10,000, I took notice.

Here’s the thing… Draper’s not alone.

John McAfee, founder of the McAfee antivirus software, says Bitcoin could hit $500,000 in three years.

Bobby Lee is CEO of BTCC, China’s first Bitcoin exchange. Today, it’s one of the largest Bitcoin exchanges in the world.

Lee predicts Bitcoin could reach $11,000 by 2020.What’s realistic?

I crunched the numbers. Back in March, I thought Bitcoin could reach $4,200 within three years. It did it in 5 months.

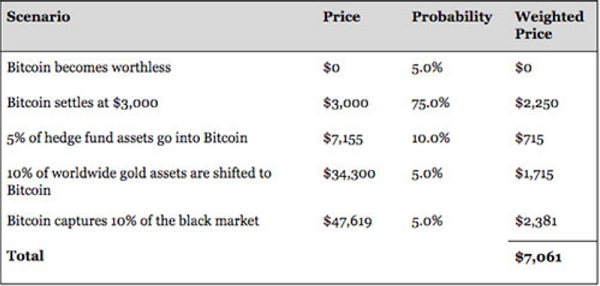

Now I’ve updated my forecast and believe Bitcoin could go to $7,061 in the next 2-3 years… and put $10,000 per bitcoin well within range.

Three Questions We Need to Ask

Bitcoin is a cryptocurrency. And like any currency (for instance, U.S. dollars or gold), it can be used to make payments, as an investment, or as a store of value.

To determine what Bitcoin could be worth over the next few years, I looked at what its price would be under each of those three scenarios.

That led me to three questions…

- What if hedge funds buy Bitcoin as an investment?

- What if investors use Bitcoin as a store of value?

- What if Bitcoin is used primarily as a currency?

I crunched the numbers on each scenario, and here’s what I found…

What If Hedge Funds Buy Bitcoin as an Investment?

Bitcoin is a perfect ballast for a hedge fund portfolio. Here’s why…

Bitcoin’s correlation to other assets is extremely low. That means its price does NOT move in tandem with other assets.

Let’s say a hedge fund wanted to diversify its portfolio of risky assets (such as small-cap stocks or junk bonds).

It could add Bitcoin to provide diversification. If a risky asset class tanks, Bitcoin would provide ballast because it’s not correlated to those assets.

Right now, the hedge fund industry has $3 trillion in assets under management. As of my March forecast, except for a few small funds, none of those assets had gone toward Bitcoin.

A lot has changed since then. There’s now 70+ hedge funds investing in or getting ready to invest in cryptocurrencies.

Originally, I estimated Bitcoin might get 3% of hedge fund money. And that would boost the Bitcoin price to $4,293.

With these new developments, however, I upped the estimate to 5%. With 5% of hedge fund money, Bitcoin could reach $7,155.

Not bad… But under the other two scenarios, it could go even much higher.

What If Investors Use Bitcoin as a Store of Value?

A good store of value is any asset that can maintain its purchasing power over time.

Historically, gold has been the go-to asset for wealth preservation. Like gold, Bitcoin can also serve as a store of value.

According to the World Gold Council, there are 186,700 tonnes of gold in the world.

That’s about 6 billion ounces. Gold trades at about $1,300 per ounce. That means all the gold in the world is worth $7.2 trillion.

In my original projection, I asked, what if just 5% (another conservative

estimate) of gold holders switch to Bitcoin?

If that happened, more than $360 billion would flow into Bitcoin. That would send the price to $17,150 per coin.

But again, a lot has changed since March. Now it’s well documented that millennials are not even considering gold, but are instead using Bitcoin for their savings.

This is significant. The population of millennials is even bigger than that of the baby boomers.

So this time around I’m assuming 10% of money in gold will shift to Bitcoin. That alone would price Bitcoin at $34,300.

What If Bitcoin Is Used as a Currency?

Bitcoin’s use as a currency is growing exponentially. It’s now accepted by 100,000 merchants across the world, including Microsoft, Dell, Wikipedia, Expedia, and PayPal.

As Bitcoin catches on, we expect more people and more businesses to use it as a medium of exchange.

However, like many new technologies, Bitcoin got its start in underground economies. Due to its anonymous nature, it’s the preferred currency for online black markets.

Let us be clear. We don’t endorse the use of Bitcoin for illicit transactions. It’s simply a medium of exchange, like cash.

(In fact, billions of dollars are used in street-level black markets every day across the world for the same reason as Bitcoin: Cash is anonymous. Nevertheless, people continue to spend, save, and invest with U.S. dollars. The same is true of Bitcoin.)

As a digital currency, Bitcoin’s price rises the more it’s used— regardless of what it’s used for.

There aren’t many concrete statistics on the size of black markets. But research suggests it could be 20% of global GDP, or $15 trillion. I’ll be conservative and use the same figure as back in March—$10 trillion.

If Bitcoin captures just 10% of that market, its price would rise to $47,619.

To reiterate, Bitcoin has already begun to emerge from the shadow economy. Today, it’s an accepted form of payment by legitimate companies.

Eventually, we believe it will be used as much as any other currency. So as Bitcoin goes mainstream, the price could go even higher than the above projection.

Our Verdict…

My original projection came out to $4,200. At the time, it was more than four times the price of Bitcoin.

With the new projection, I believe Bitcoin could realistically go to $7,061 in the next 2-3 years.

What’s different? This time around I upped the percentage of hedge fund money going into Bitcoin and the amount of money shifting from gold to Bitcoin.

I also decreased the probability that Bitcoin will go to zero, increased the probability of hedge fund assets moving into gold, and increased the Bitcoin settle price.

Here’s how I came to that number…

I calculated the expected return based on the probability of each scenario happening (see the table above).

Here’s how to read the table:

- The first column lists the various scenarios I’ve laid out above.

- The second column lists the price of Bitcoin if that scenario comes to pass.

- The third column lists the probability of a scenario happening.

- The fourth column is the weighted average price. (It multiplies the price by the probability of the event happening.)

Some would call this a conservative analysis.

And let’s not forget: We looked at each scenario in isolation.

Any combination of these events could send prices much higher than my estimate, putting $10,000 per bitcoin well in range.

Don’t Dismiss Bitcoin’s Ride Higher

If you watch the network effects of Bitcoin like I do, you see that it’s only getting stronger. (The network effect occurs when a good or service becomes more valuable as more and more people use it.)

My message today: Go out and buy some Bitcoin.

Currently, Bitcoin trades over $5,000 per coin. But you can buy much smaller units than that.

For just a few bucks, you can take part in the greatest technological innovation since the internet. And potentially make many times your money doing it.