Artificial intelligence is becoming a permanent fixture in our lives, so why not embrace it? Take advantage of Keith Kaplan’s latest financial AI platform, Project An-E 2.0, by reading this informative Predictive Alpha Options review. Start earning big returns on your investments today.

Predictive Alpha Options An-E 2.0 System – See It In Action Here

Table of Contents

Predictive Alpha Options Review – What Is It?

What happens when you take the winning power of Predictive Alpha’s AI machine and set it towards the options market? Opportunity for larger than normal, quick wins.

Predictive Alpha Options brings you the power of TradeSmith’s proprietary A.I. program, An-E, but leveraged for options trades. With machine learning variables loaded in specifically to analyze sell and puts, this tool simplifies options-based trading so you can spend more time focusing on doing the things you love.

What Is TradeSmith An-E 2.0?

TradeSmith has been hard at work exploring this technology for the past year, ever since they debuted the original version of An-E — TradeSmith’s proprietary A.I. designed to forecast the price moves of stocks in their database roughly four weeks in advance.

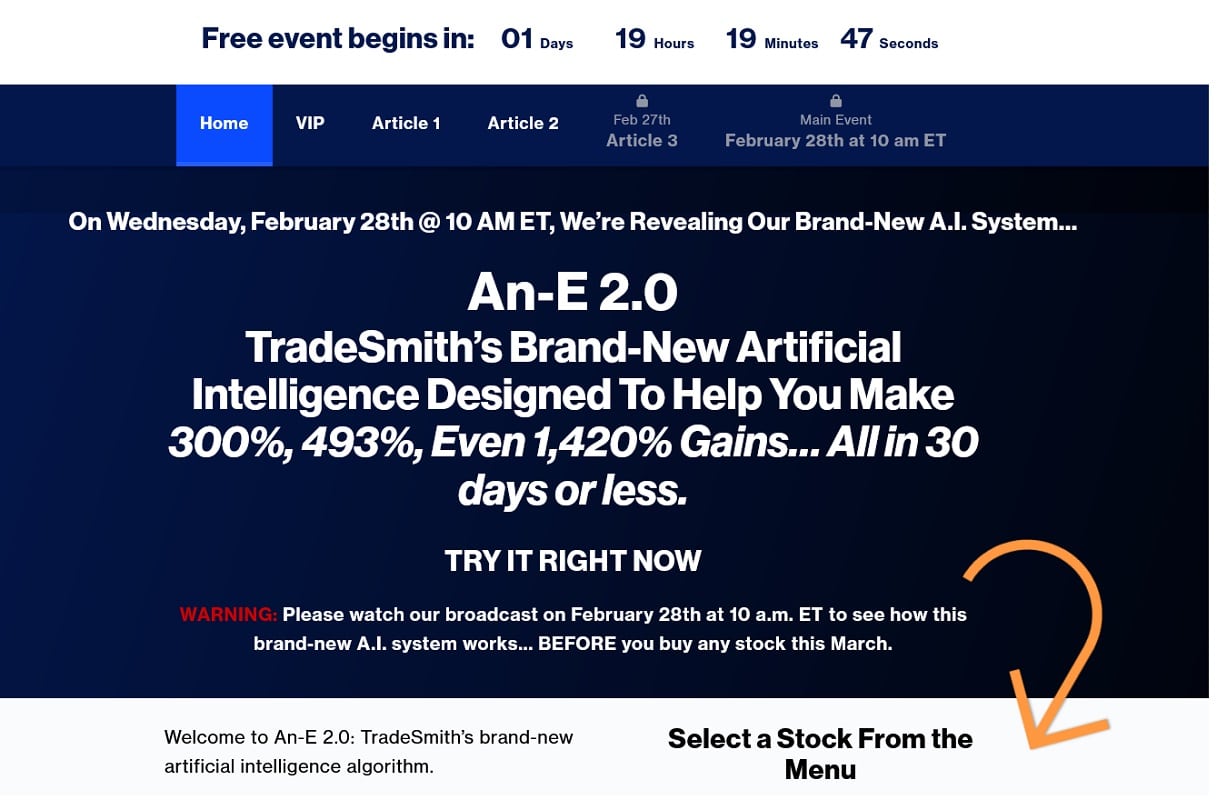

But this week, An-E 2.0 is set for release. And with this release comes an all-new way to trade An-E’s predictions.

Keith Kaplan, CEO of TradeSmith and the brains behind An-E, has all the details for you below. And if you’d like to test drive An-E 2.0 yourself, go right here and enter your email for limited-time access to the newest upgrade.

How Does Project An-E 2.0 Work?

According to TradeSmith team, only 64 stocks in the S&P 500 are trading above their 50-day moving average. That means 436 stocks are not.

That’s 64 opportunities to trade positive short-term momentum… and hundreds to trade to the downside.

That alone is an edge you can exploit… if you have a lot of time to go through charts.

And of course, there’s no guarantee either trend will continue.

To help solve this problem, TradeSmith debuted An-E last year. It’s short for Analytical Engine — an A.I.-driven tool that can forecast the move of any stock you track 21 trading days in advance.

And right now, you can use An-E 2.0 on a handpicked selection of names — like NVDA, SMCI, AMD, and more — for free.

Go right here to learn how… and then stick around for news on Wednesday’s presentation of An-E 2.0.

This upgrade brings with it a ton of improvements, including a way to use An-E’s predictive power to multiply the move of any stock, up or down, into much larger gains.

Right now, with volatility perking up, is the perfect time to start using short-term trading tools like this one. An-E’s upgrade couldn’t have come at a better moment.

I highly suggest you see the results for yourself right here… and make sure to attend Wednesday’s event at 10 a.m. Eastern to learn all about how An-E 2.0 can help short-term traders dominate this market — posting gains that make even the daily moves of NVDA and SMCI look tame.

Is Predictive Alpha Options Legit?

As you may know, last spring, TradeSmith unveiled its proprietary A.I. algorithm, dubbed Predictive Alpha, or “An-E” (short for analytical engine), which can project nearly any given stock’s price 21 trading days (or roughly one month) into the future.

That alone is an astonishing accomplishment; it may not be a crystal ball, and there are always exceptions to be made, but let’s take a look at an example…

Take Clearway Energy Inc. (CWEN).

Clearway is a leading renewable energy company focused on the development, ownership, and operation of clean-energy assets across the U.S. It delivers reliable, cost-effective renewable energy solutions that help meet the growing demand for clean electricity while reducing carbon emissions.

Although it faced challenges last year due to higher interest rates, the company increased its dividend yield to reach record highs, presenting a great investment opportunity for TradeSmith’s new algorithm.

So, back in August 2023, An-E projected, over one month, the stock price would rise 5.6%.

Clearway actually rose 3.9%. That’s a quick $39 profit if you invested $1,000. Not so bad. An-E’s prediction was a bit optimistic, but it still resulted in a profitable outcome.

These predictions with An-E could deliver some really nice gains — and help avoid painful losses…

But being the innovators at TradeSmith, their next question was: “How can we make An-E better? How can we make this A.I. truly stand out?”

And after even more man hours, more money invested, and more pushing of the envelope…

Keith Kaplan and his team at TradeSmith created An-E 2.0.

Using Clearway again, with An-E 2.0, you could have had a chance at a much better outcome — but in the same amount of time.

- So, you could either invest $1,000 for a $39 profit with the original An-E…

- Or, you could risk far less capital with a $500 stake and turn a profit of $1,685!

That’s half the initial investment… for about 43 times the reward… for a whopping 337% gain in the same time frame.

With its ability to process complex information and adapt to changing market conditions, An-E 2.0 is increasingly becoming an indispensable tool in the realm of investing.

And on Wednesday, Feb. 28, at 10 a.m. Eastern, Keith Kaplan and his team at TradeSmith are going live with the first-ever unveiling of An-E 2.0…

And they’re even giving away a stock pick… completely FREE!

To make sure you attend, go right here and save your spot.

Predictive Alpha Options Review: Is It Worth it?

On Wednesday, Feb. 28, TradeSmith will follow up last year’s first “small” step with a giant leap.

After $18 million in R&D spending and dozens of machine-learning engineers spending countless hours at work, An-E 2.0 is set to launch.

This upgrade comes with a profound level of profit acceleration… and a technique that can take small stock moves and translate them into much bigger short-term wins.

One such example, which we’ll share in the launch presentation on Wednesday, could have turned a small gain of 7.7% into a return of more than 900% over the same time frame.

To learn a bit about how — and get limited-time access to test out An-E 2.0 for yourself, click right here and sign up for Wednesday’s event